BLOOMFIELD, Conn. — Jacobs Vehicle Systems has introduced Active Decompression Technology (ADT) that enables heavy-duty commercial vehicles to benefit from an engine stop-start system and eliminating engine-shake at both start-up and shutdown.

In addition to improving fuel economy and reducing emissions, ADT also improves cold engine starts, reduces loading and wear on engine components during start-up, and makes start-up faster.

Jacobs’ ADT device incorporates valve actuation technologies proven over many millions of miles and can be cost-effectively added to many engine platforms, according to Steve Ernest, vice president of engineering and business development.

“Stop-start engine technology, which automatically switches off the engine when it would otherwise be idling, is widely adopted by automotive manufacturers, however, it is less common in heavy-duty commercial vehicles,” Ernest said. “This is largely because of the intrusive engine and cabin-shake experienced whenever a heavy-duty diesel engine starts or stops, and because of the cost of technologies needed to mitigate increased wear-and-tear on the starter motor, ring-gear, and battery. ADT significantly reduces these issues.”

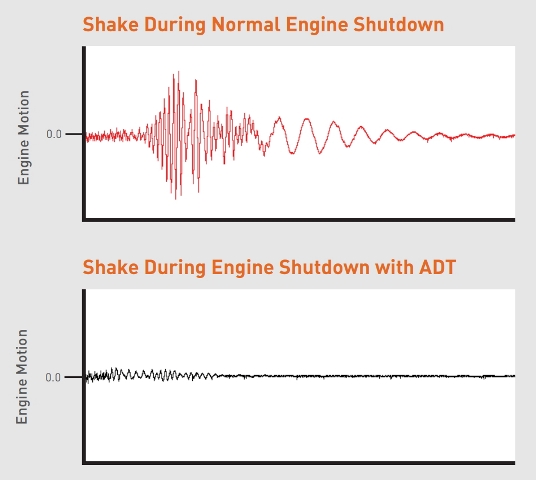

Ernest said extensive testing had shown that ADT reduces the magnitude of engine-shake during shutdown by 90 percent, which is when vibrations transmitted to the cabin are of greatest frequency and strength. This has the additional benefit of preventing disturbance to drivers sleeping in cabs overnight when there are automated engine starts and stops to maintain battery charge.

The ADT device is automatically activated by the engine control unit (ECU) whenever the engine shuts down or starts up, and works by keeping the engine valves open and the cylinders decompressed.

“When switching off the engine, it coasts to a smooth shutdown without causing the cab to shake,” Ernest said. “When starting up, the engine is kept in a decompressed state which decreases cranking torque by 40 percent and allows the engine to spin up to twice its normal speed for smoother starting, faster priming of the fuel system, and decreased wear on the starter gear, fly wheel and other components. This can also allow the use of smaller and lighter batteries, cables, and starter.”

By enabling the engine to be turned-over while decompressed, ADT also improves start-ups in cold temperatures by enabling the engine to reach its critical compression ignition speeds. When combined with supplemental air inlet heaters, ADT also enables the engine cylinders to be pre-warmed without the engine load from compression; especially useful when freezing temperatures have reduced battery levels. When high cranking speed is reached, the engine compression is reactivated and cylinder-fuelling begins.

“ADT is another development of Jacobs’ well-proven valve actuation technologies to deliver another set of benefits,” Ernest said. “Some OEMs will be interested in ADT because it enhances vehicle refinement by eliminating engine-shake and cabin-shake. Other customers – particularly those whose vehicles endure heavy stop-start cycles – will welcome the reduced component load, fuel economy and emissions advantages.”

The launch of ADT follows the recent introduction of two other new applications of Jacobs’ valve actuation technology: 2-Step VVA (variable valve actuation) and CDA (cylinder deactivation technology).

The 2-Step VVA system on the intake valve manipulates the timing of valve-closing to optimize compression ratio versus load, and improve emissions.

When applied to the exhaust valve, the timing of the valve opening is modified to improve transient turbocharger response and to keep the aftertreatment system hot during low load operation.

CDA disables the opening of the intake and exhaust valves of non-fueling cylinders to achieve higher exhaust temperatures in the operating cylinders, reducing emissions, and increasing exhaust temperatures for improved SCR (Selective Catalytic Reduction) efficiency.

Operating fewer cylinders enables large engines to have the fuel economy of smaller engines.

To learn more about ADT click here.

The Trucker News Staff produces engaging content for not only TheTrucker.com, but also The Trucker Newspaper, which has been serving the trucking industry for more than 30 years. With a focus on drivers, the Trucker News Staff aims to provide relevant, objective content pertaining to the trucking segment of the transportation industry. The Trucker News Staff is based in Little Rock, Arkansas.