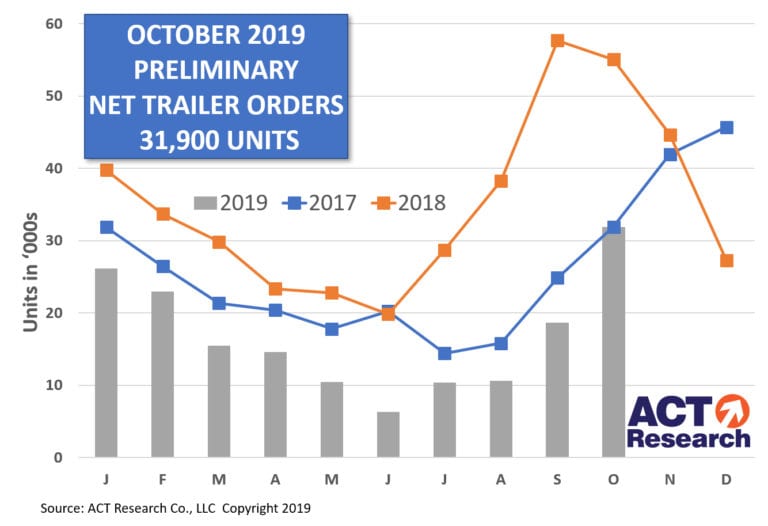

The two analytic companies that track, analyze and report commercial vehicle orders and sale said that net trailer orders in October almost reached 32,000.

ACT Research said orders surged 71% month-over-month, reaching 31,900.

FTR said the trailer ordering season was off to a vibrant start with sales of $31,800.

Both, however, quickly noted that orders were down 42% from the same month in 2018.

Trailer orders for the past 12 months now total 241,000 units, FTR said.

“After a lackluster summer, order volume has now surged for two straight months, and is tracking more in line with historic seasonal order patterns,” said Frank Maly, Director–CV transportation analysis and research at ACT Research. “October order strength was highly concentrated in dry vans, where orders were more than two times that of September. A counterpoint to the net order surge was continuing elevated cancellations, occurring in both dry vans and reefers. Since we are approaching year-end, it is likely that cancellations are due to a combination of several factors. Some placeholder orders are likely being cleared from the system and it is also likely some production is being shifted into early 2020, either at OEM or fleet request.”

The high October order totals were achieved despite still elevated cancellations, as a few OEM’s continue to clean up their 2019 backlogs, FTR said, adding that October production is expected to be down moderately on a per-day basis due to seasonal factors, with backlogs climbing slightly for the first time in 10 months.

“This is great news for the trailer market,” said Don Ake, FTR vice president of commercial vehicles. “Several large dry van fleets placed requirement orders for 2020, showing they have confidence in the freight markets going into next year. Dry van orders were strong despite a lull in freight growth. There still is plenty of replacement demand present and fleets continue to need more dry vans to move products quickly to and between warehouses due to increased online sales.”

Ake said the vocation trailer markets, such as flatbeds and dumps, are still struggling as the industrial sectors of the economy weaken. Refrigerated van orders are expected to increase soon. “The higher October orders suggest the market will be decent in 2020, although down significantly from the expected record production volume of 2019. The trailer market is slowing, but a significant downturn is not imminent,” he said.

The Trucker News Staff produces engaging content for not only TheTrucker.com, but also The Trucker Newspaper, which has been serving the trucking industry for more than 30 years. With a focus on drivers, the Trucker News Staff aims to provide relevant, objective content pertaining to the trucking segment of the transportation industry. The Trucker News Staff is based in Little Rock, Arkansas.