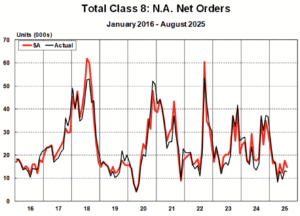

COLUMBUS, Ind. — Final North American Class 8 net orders totaled 12,844 units in August, down 21% y/y, as published in ACT Research’s latest State of the Industry: NA Classes 5-8 report.

“August marks the eighth consecutive month of y/y Class 8 order declines,” said Carter Vieth, research analyst, ACT. “Even with the caveat that August is a seasonally weak order month, just ahead of next year’s orderboards opening, this month’s tractor orders of 7,493 units, down 34% y/y, were notably weak, but in line with the trend since April. Current tariff and regulatory purgatory continue to sow industry uncertainty.”

“Vocational Class 8 orders totaled 5,351 units, up 7.8% y/y, but on easy y/y comps, as last August was the weakest month for vocational orders in 2024, on a ytd basis, vocational orders were down 20% in 2025 compared to 2024,” Vieth said. “Vocational, like the tractor market, continues to be hampered in the short-to-medium term by policy fluctuations related to tariffs, federal funds, and regulations. Also, softness in end markets like housing are not helpful.”

Regarding medium duty, Vieth noted that total Classes 5-7 orders fell 24% y/y to 14,613 units. MD orders have slowed notably this year, as still elevated inventories, a weaker economic outlook, and notable increased consumer pessimism weigh on MD demand.