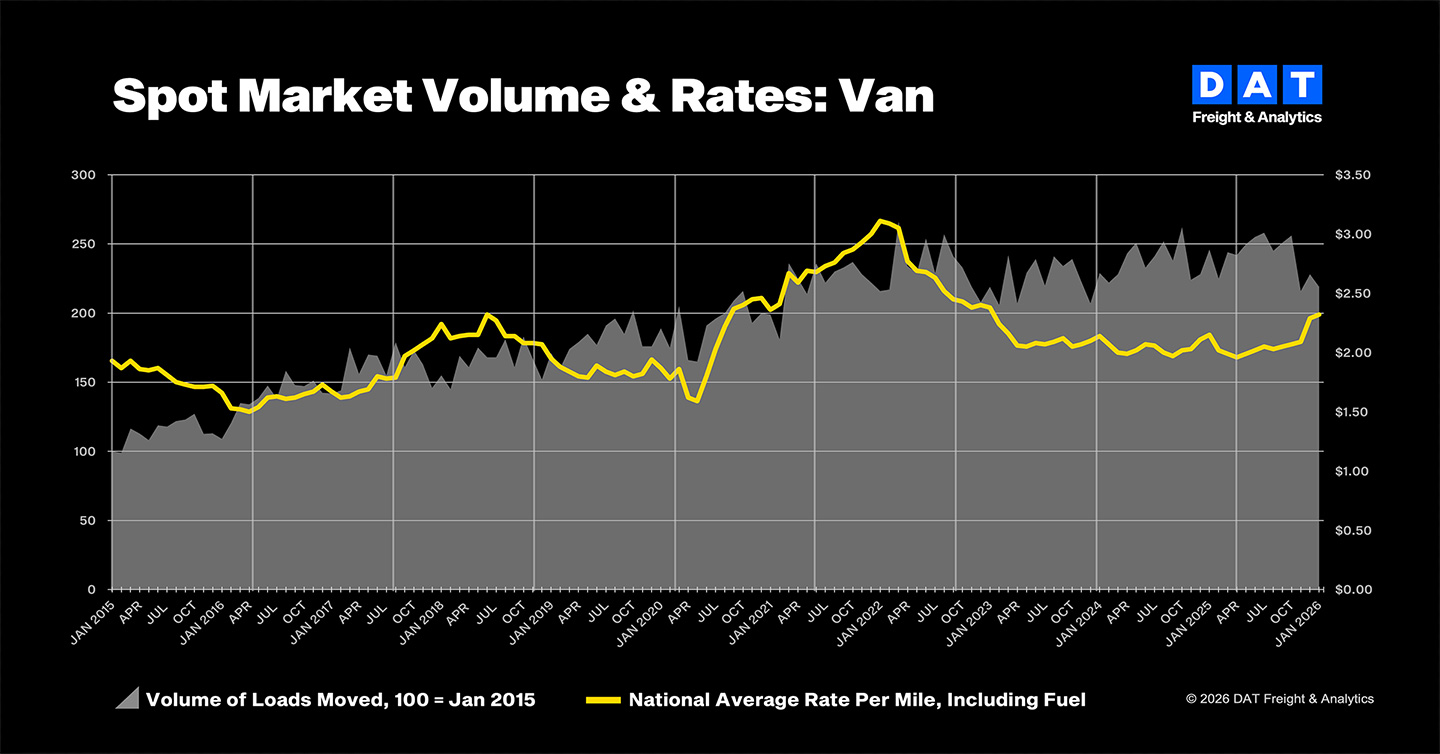

PORTLAND, Ore. — According to a Feb. 13, 2026, report from DAT Freight and Analytics, truckload freight volumes declined in January following the holiday shipping season, while spot market rates continued to build on December gains.

The DAT Truckload Volume Index (TVI), which measures demand for truckload services, declined month over month for van and refrigerated (reefer) loads, reflecting a post-holiday slowdown in retail and food shipments:

- Van TVI: 219, down 4% compared to December 2025;

- Reefer TVI: 184, down 4%; and

- Flatbed TVI: 257, up 2%.

Spot pricing: Strong start to the year

Despite softer freight volumes, average spot rates increased in January, particularly for refrigerated and flatbed loads:

- Spot van rate: $2.32 per mile, up 3 cents from December 2025;

- Spot reefer rate: $2.81 per mile, up 12 cents; and

- Spot flatbed rate: $2.85 per mile, up 22 cents.

Strong gains in flatbed freight signaled continued demand for specialized equipment to move construction and industrial materials, especially in challenging winter conditions.

Winter Storm Fern disrupted transportation networks generally, sidelining truckload capacity and reducing supply chain productivity across 24 states. Tighter effective capacity helped boost spot-market pricing despite lower truckload volumes.

Year over year, spot rates continued to track higher. The average spot van rate was up 17 cents from January 2025, while the reefer rate was up 27 cents. Spot flatbed rates increased 41 cents year over year.

Contract rates: Stable in January

Contract rates remained largely unchanged in January:

- Contract van rate: $2.48 per mile, up 2 cents month over month

- Contract reefer rate: $2.81 per mile, up 2 cents

- Contract flatbed rate: $3.04 per mile, down 1 cent

“Not every spike or dip warrants a response,” said Ken Adamo, DAT chief of analytics.

“What matters is whether the data signals a temporary disruption or a real shift in market fundamentals,” he continued. “January’s numbers didn’t mark a change in loads moved, but they did show how shipper urgency and carrier pricing discipline can push rates up despite softer volumes.”

Linda Garner-Bunch has been with The Trucker since 2020, picking up the reins as managing editor in 2022. Linda has nearly 40 years of experience in the publishing industry, covering topics from the trucking and automotive industry to employment, real estate, home decor, crafts, cooking, weddings, high school sports — you name it, she’s written about it. She is also an experienced photographer, designer and copy editor who has a heartfelt love for the trucking industry, from the driver’s seat to the C-suite.