ORLANDO, Fla. — Trucker Tools has released what the company called “several growth milestones” and introduced new, customer-inspired features for its Smart Capacity platform and Mobile Driver App.

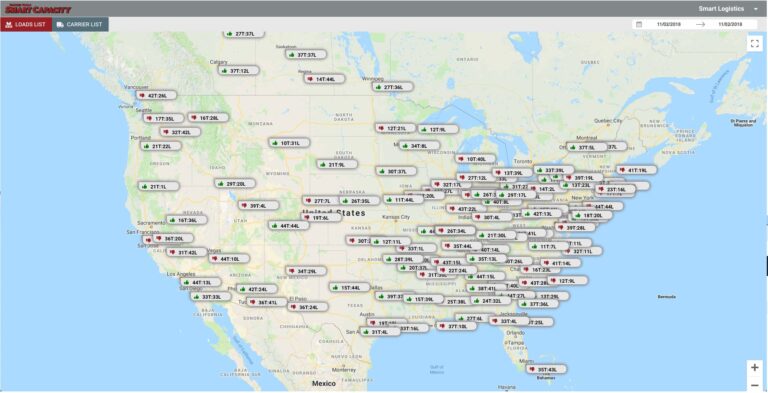

The new features improved the platform’s predictive freight-matching, real-time capacity visibility, automated load tracking, shipper intelligence and driver support tools for independent truckers and small fleet operators, freight brokers and 3PLs, according to Prasad Gollapalli, founder and chief executive of Trucker Tools.

The company announced two growth milestones. The Trucker Tools Mobile Driver App, launched in 2013, surpassed 600,000 downloads. The smart-phone-based, GPS-enabled app provides automated load-tracking and streamlined load tendering for drivers and has 16 of the most sought-after features drivers use to manage their business while on the road. The number of “micro carriers – small fleet operators mostly with 10 trucks or less – using the app and portal also crossed the 125,000 threshold, providing brokers with a critical mass of connected, independently-operated truckload capacity, on a secure platform.

In addition, since March 2018, Trucker Tools doubled the number of freight brokers and 3PLs contracted on the Smart Capacity platform, utilizing its tools for capacity and load visibility and planning, predictive freight-matching, carrier relationship development and building reliable small-carrier capacity.

Gollapalli said the mobile driver app, combined with Smart Capacity’s planning functionality and real-time, accurate information on available loads and trucks, gives brokers precision intelligence on when and where trucks are available today and days into the future. The platform’s intuitive workflows dramatically compress the cycle to reliably match truck to load, saving time, and giving brokers collaboration tools with which, they can build trusted relationships with independent truckers and small fleets to improve capacity.

“The significant growth of users for both our mobile app and the Smart Capacity carrier-management platform and portal demonstrates our traction in the market. We are working with our customers – carriers and brokers – to create solid technology solutions to real-world business problems they face today — and will continue to face in a market that’s evolving and changing and an unprecedented pace,” Gollapalli said.

“Our focus is to be the technology provider of choice, a trusted partner that listens to [carrier and broker] needs, understands their business issues, and then develops the software applications necessary for them to adapt, grow and continue stay ahead of competitors – and their customer’s needs,” he said.

Through ongoing engagement and feedback, Trucker Tools learned that drivers and brokers on the platform continually cited the need for a more automated process to shorten the cycle to find, match and accept a load with a truck. In response, Trucker Tools built and introduced “Book it Now” as the latest new feature of Smart Capacity and the mobile driver app.

Book it Now is a fully automated process, preferred by carriers. With this feature, a driver or dispatcher reviews (on their smart phone or tablet) a list of participating brokers’ available loads (with pricing) that match available capacity and are in that fleet’s or driver’s preferred lanes. Each entry has a “Book it Now” button next to it.

Once the driver/dispatcher clicks on Book it Now, the load is booked and recorded in the broker’s TMS, a confirmation email is issued to the driver/dispatcher, and the load is scheduled for pickup. A broker’s intervention is needed only if the driver and broker want additional conversation.

The broker has the option of selecting what loads go through the automated Book it Now process. They also have the option to engage with the process and more closely monitor and manage a Book it Now load, which could include talking to the carrier, confirming the rate or checking other details.

“The broker can still call the carrier to confirm things like type of equipment, availability, timing and other details. However, the intelligence and process algorithms we built into the system fully automates the process.” noted said Murali Yellepeddy, Trucker Tools chief technology officer. These and other Smart Capacity enhancements are helping brokers and carriers cover more loads in far less time than with more manual methods.

“That’s time they can use to book more loads. And drivers liked it, too, for ease of use, simplicity, transaction speed and accuracy,” he said.

As part of the load-matching and auto-booking process, the Smart Capacity system continually “learns” about the carrier’s and broker’s preferences, analyzing historical data and trends, such as preferred lanes, loads and shippers. Using that intelligence, with every Book It Now confirmation email sent to the driver/dispatcher, the system also sends a suggested list of future available loads-for-tender, which reflect the driver’s preferences and are in proximity to where the current load will be delivered.

“They get an advance look at available future loads, ranked with best on top, according to their history and preference,” Yellepeddy said. “It’s a tremendous advantage for the driver to know, with certainty, before even their current load is delivered, what reliable options there are for the next load down the road and when it’s available. And then to be able to accept and secure that load in advance.”

This saves time and expense for the driver, who otherwise would be sitting and waiting and not making any money. Instead, the driver can plan forward and have the next load confirmed without delay.

Detention time, waiting for a load or unload – without being paid — at the shipper’s facility, is the bane of every trucker’s existence. To help drivers, carriers and brokers better manage this problem, Trucker Tools has built and implemented a Detention Alerts feature.

“The moment the carrier arrives and stops at the shipper’s facility, a time-stamp is issued, and a clock starts tracking wait time,” explained Yellepeddy. “This can be configured for whatever time period the broker wants, typically one or two hours. Once the wait time reaches the trigger, and alert is issued to the broker, so the broker can call the shipper and help expedite getting the driver loaded or unloaded and released.” Detention alerts can be set up with any driver on the Trucker Tools Mobile Driver App.

Phase 2 of this feature, Detention Scorecards, is under development and will be implemented in June. Scorecards will let drivers assess and grade their interactions and experience with a shipper, integrating other driver reviews, comments and photos of the shipper’s facility and loading docks. The scorecard also will incorporate historical detention trends, and driver feedback on shippers’ detention practices.

“Detention history and grades will be available to anyone on the platform,” said Yellepeddy. “So, someone tracking a load, or considering an available load, can look up a current review on that shipper’s location. Drivers and dispatchers to make better informed decisions on which loads to take – avoiding those shippers who make drivers wait excessively. It also will help brokers educate shippers on where they need to improve to get a better grade and make themselves more attractive to carriers.”

For more information on Trucker Tools Smart Capacity, and the recent functionality improvements and additions, visit www.truckertools.com, call (703) 955-3560, or email us at [email protected]

The Trucker News Staff produces engaging content for not only TheTrucker.com, but also The Trucker Newspaper, which has been serving the trucking industry for more than 30 years. With a focus on drivers, the Trucker News Staff aims to provide relevant, objective content pertaining to the trucking segment of the transportation industry. The Trucker News Staff is based in Little Rock, Arkansas.