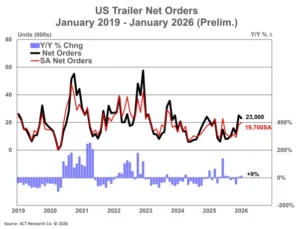

COLUMBUS, Ind. — Preliminary net trailer orders in January were down about 2,000 units from December’s 25,100-unit level, an 8% month-to-month decrease.

“Sequentially, a drop in net orders was expected, as December is usually the second strongest order month of the annual cycle,” said Jennifer McNealy, director CV market research & publications at ACT Research. “January is usually the month when trailer makers begin to take fewer orders and start to work down the backlog that grew during the peak of order season, October through December. That said, fleet decision-making hesitance into late 2025 seems to have delayed the cycle a bit, causing January orders to follow the traditional pattern but still surprising on the high side, as December’s weather-induced spike in freight rates, increasingly aged fleets, and some level of tariff-related clarity are in play for trailing equipment demand.”

At 23,000 units booked in January, order intake was more than 9% above January 2025’s level. Seasonal adjustment (SA) at this point in the annual order cycle lowers the monthly tally to 19,700 units. Final January trailer industry data will be available later this month. This preliminary order estimate is typically within ±5% of the final order tally.

“The questions now become how sustainable are 20k-plus-unit order intake months, and how quickly will trailer OEMs build down the still-thin backlog, particularly given concerns about the level of activity in the key freight generating economic sectors that drives transportation demand, still-weak, although improving, for-hire carrier profitability, and uncertainty about future government policies that remain as challenges to stronger trailer demand in the near term,” McNealy said.