In times of economic uncertainty business owners in all sectors tend to think long and hard before investing their money in capital expenses.

In the trucking industry, the uncertainties of 2025 have led to carriers delaying purchases of tractors and trailers. No one is sure when the economy will brighten, or when the freight market will improve.

In the meantime, fleet owners are looking for ways to protect their equipment while waiting for a break in either policy or pricing.

TCA addresses the issue

In November, the Truckload Carriers Association (TCA) addressed the issue in “Future-Proofing Your Fleet: Smart Procurement Strategies Amid Tariffs and Market Uncertainty.” In addition to moderator Lucas Subler, president of Classic Carriers, speakers included Ken Vieth, president and senior analyst at ACT Research, and Don Durm, vice president of supply chain for PLM Fleet LLC.

While the webinar was presented by TCA’s Refrigerated Division, the principles apply to all areas of the freight industry.

At the time of this writing, the future of the Trump administration’s tariff policy is currently tied up in the courts, with the U.S. Supreme Court hearing arguments about the power of the president to impose taxes — including tariffs — is constitutional.

“Many believe the administration’s use of the International Emergency Economic Powers Act as a mechanism to unilaterally levy tariffs is not in line with the Act’s intent,” Durm said.

The courts will eventually rule on the issue, but even if they find the tariffs unconstitutional, the administration has several other options on the table. Ultimately, if tariffs are allowed to continue in their present form, 80% of the cost will be passed onto manufacturers and consumers.

So, what does this mean for the trucking industry?

“Truckers buy equipment to haul freight, but fundamentally truckers buy equipment to make money,” Vieth noted.

With the added cost of tariffs, the ability to cycle equipment in the most opportune manner (five to seven years) is becoming more difficult. For example, current tariffs can raise the consumer price of a refrigerated trailer by as much as $10,000.

A question of now or later

Fleet managers find themselves faced with a tough question: Is it worth the extra cost to invest in new trailers right now, or will prices drop in the next year or so?

Waiting to buy new equipment may save money in the short term — but in the long term it could require a carrier to outlay a lot of capital at one time. In either case, the five- to seven-year replacement calendar will be impacted.

One issue buyers must consider is the risk of making a purchase when manufacturers can’t offer reliable price quotes on equipment.

The economics of supply and demand are changing so quickly that the actual price can’t be determined until late in the manufacturing process. Many manufacturers are slowing down the assembly lines to keep their employees on board during this period of low demand. Slower manufacturing means price volatility and a longer period before delivery.

In general, trailer manufacturing is a depressed market in these economic times, Durm suggests. But manufacturers want to keep their employees working in expectation of a subsequent boom in the next couple of years.

Impact on equipment cycle

The challenge created under tariff uncertainty is one that impacts the equipment cycle.

If a carrier purchases trailers today, with a $10,000 added tariff, it might find itself upside down on the purchase — depending on the outcome of court rulings involving tariffs. If the tariffs are removed, the carrier has essentially overpaid for the trailer and assumed risk.

Leasing or renting equipment let buyers shift that risk to other entities and allow for planning of cycling assets during a time when demand for new trailers is subdued.

The key is for carriers to mitigate risk and insulate themselves by expanding the life cycle of equipment.

“The refrigerated trailer fleet of the U.S. is as old as it has ever been,” Durm said, noting that carriers that bought trailers during the past five years are, in general, underwater on them. The demand for tractors is also down, leading to similar notations in the accounting books.

In 2024 about 450,000 trailer units were manufactured in the U.S. That number is expected to slide to 435,000 in 2026. But with carriers not investing in new equipment, the supply side is growing in terms of tractors and trailers. Demand for freight needs to increase if the manufacturing process is to ramp up activity.

Return to mixed fleets

In mitigating risk, many carriers are turning to mixed fleets that include pieces of equipment that are owned, leased and rented. The advantage of a mixed fleet is the ability to quickly change capacity when the market improves.

This is most obvious in the refrigerated trailer market. From 2020-2024, equipment demand was low, with average reefer production at 42,500 units during those years. In 2025, only 24,500 units were produced. The outlook for 2026 isn’t much better.

The result? There’s a lot of older equipment on the road.

The challenge is keeping older fleets operable until the switch for demand is flipped and there’s sudden demand for new equipment. This will happen one way or another, as the old equipment is becoming too expensive to maintain and will have to be replaced in short order.

Carriers are advised to be ready to act quickly when demand does increase; the waiting list to replace outdated tractors and trailers will quickly grow long.

Change is a tweet away

So, when will change happen? And when will that demand switch flip? Unfortunately, those are questions no one can answer.

The full impact of tariffs is expected to be felt in mid to late 2026. Relief may be provided, depending on court rulings. However, even if those rulings are favorable, tariffs on steel, aluminum and other manufacturing materials are expected to remain. Inflation pressure is expected to decrease in 2027.

While no one can predict what is going to happen in these economic times, one thing is certain: The switch for demand in equipment will eventually be flipped, and carriers can expect long lines for delivery of new equipment.

As Vieth said, “We are only a tweet away from a change in the industry’s economy.”

This story originally appeared in the January/February 2026 edition of Truckload Authority, the official publication of the Truckload Carriers Association.

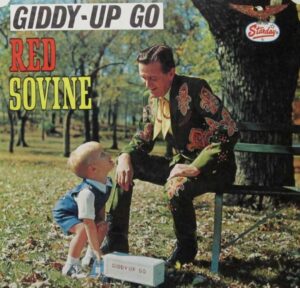

Since retiring from a career as an outdoor recreation professional from the State of Arkansas, Kris Rutherford has worked as a freelance writer and, with his wife, owns and publishes a small Northeast Texas newspaper, The Roxton Progress. Kris has worked as a ghostwriter and editor and has authored seven books of his own. He became interested in the trucking industry as a child in the 1970s when his family traveled the interstates twice a year between their home in Maine and their native Texas. He has been a classic country music enthusiast since the age of nine when he developed a special interest in trucking songs.