COLUMBUS, Ind. — ACT Research is reporting a high rate of cancellation orders along with lower a trailer backlog/build.

According to this month’s issue of ACT Research’s State of the Industry: U.S. Trailers report, with the majority of 2025 in the rearview mirror, the US trailer market remains in “stay afloat” mode, as fleets continue their wait-and-see strategy.

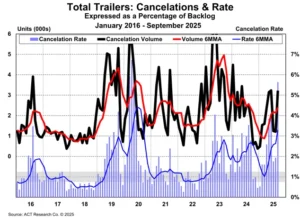

“Cancelations started to escalate in February and have remained elevated relative to backlog since,” said Jennifer McNealy, director–CV market research and publications, ACT. “September’s rate, as a percentage of backlog, was 5.6%, both overstated and the highest rate since May 2020. Data continued to show high dry van cancelations, with reefers and the tank segments also elevated. Per OEMs, cancelation activity is primarily from dealers, as they work to control stock against a backdrop of uncertainty and cost concerns.”

“With lower build rates insufficient to offset soft orders in September, the industry backlog-to-build ratio fell 30 basis points sequentially, to 3.3 months,” McNealy said. “September’s build rate and the current backlog commit the industry into the start of 2026.”

ACT: Trailer order cancellations rise in September

Comment