COLUMBUS, Ind. — Lower trailer backlog/build and elevated cancellations in October, hit the trucking industry hard.

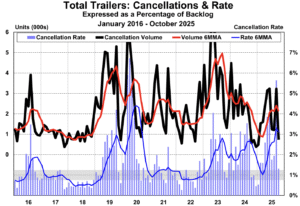

“October’s trailer cancellation rate, as a percentage of backlog, was a more subdued 1.3% versus last month’s overstated 5.6%,” said Jennifer McNealy, director–CV market research & publications at ACT Research. “Data continued to show elevated cancellations in reefer and tank segments. The largest level of cancels came from the tank segments, attributed to a decline in oil/gas activity, in general.”

According to this month’s issue of ACT Research’s State of the Industry: U.S. Trailers report, with the majority of 2025 in the rearview mirror, the US trailer market remains in “stay afloat” mode, as fleets continue their wait-and-see strategy.

“With higher build rates, lower backlogs, and two more production days in October, the industry BL/BU ratio remained at 3.3 months for the second consecutive month,” McNealy said. “October’s build rate and the current backlog commit the industry into mid-Q1’26. Overall, backlog remains at rock-bottom levels with the new year’s orderboards opening.”