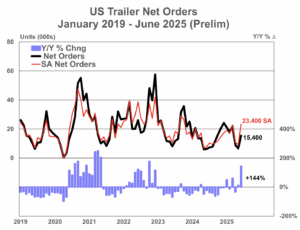

COLUMBUS, Ind. — Preliminary net trailer orders jumped nearly 8,800 units from May to June, a 133% month-to-month increase.

“Lower June net order intake was expected, as it is one of the weaker order months of the annual cycle, so June data surprised to the upside,” said Jennifer McNealy, director CV market research and publications, ACT Research. “That said, OEMs have been sharing for the past several months that amid the lower order placements, they have seen a flurry of quotation activity,. While speculative, we suspect this may be a pull-forward of demand in advance of anticipated price increases. And although this is good near-term news, supporting build rates in 2025, concern remains that weak for-hire carrier profitability continues to be an ongoing challenge to stronger demand.”

Orders 144% Higher Compared to June 2024

At almost 15,400 units booked in June, order intake was 144% higher compared to June 2024. Seasonal adjustment (SA) at this point in the annual order cycle raises June’s tally to 23,400 units. Final June results will be available later this month. This preliminary market estimate is typically within ±5% of the final order tally.

“With weak for-hire truck market fundamentals, low used equipment valuations, relatively full inventories, high interest rates, and the ambiguity of policy shifts still in play, ACT’s expectations for subdued build and order intake levels during 2025 remain intact,” McNealy said. “Additionally, preliminary data show cancel rates continue to be elevated, and in aggregate our standard notice that one month’s data does not make a trend is worth reiterating.”