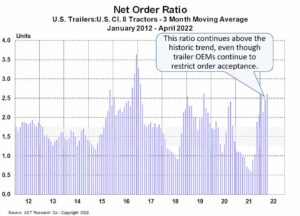

COLUMBUS, Ind. – April net U.S. trailer orders of 19,614 units decreased more than 48% from the previous month, but were 23% higher compared to April of 2021, according to this month’s issue of ACT Research’s State of the Industry: U.S. Trailer Report.

ACT Research’s State of the Industry: U.S. Trailers report provides a monthly review of the current US trailer market statistics, as well as trailer OEM build plans and market indicators divided by all major trailer types, including backlogs, build, inventory, new orders, cancellations, net orders and factory shipments.

It is accompanied by a database that gives historical information from 1996 to the present, as well as a ready-to-use graph packet, to allow organizations in the trailer production supply chain, and those following the investment value of trailers, trailer OEMs, and suppliers to better understand the market.

“Order placement remained choppy in April, and dry vans, with a 64% month-over-month slide in net, were responsible for the total industry decline,” Frank Maly, director–commercial vehicle transportation analysis and research at ACT Research, said. “Despite April’s drop, OEMs continue to negotiate with fleets and that effort is building a large group of staged/planned orders that are not yet officially posted to the backlog. Once OEMs gain sufficient confidence in their supply chain and labor availability to open 2023 production slots, expect a surge of orders to be ‘officially’ accepted.”

Malay said the industry has normally not been willing to push their commitments past 12 months and crossing into a new calendar year this quickly would not normally be under consideration.

“However, recent years, including the pandemic-battered 2020/21, have been anything but normal, leading us to expect some OEMs to begin viewing deeper order boards, with appropriate cost/price protections, which would result in both a competitive advantage and improved fleet relations,” Malay said.

Malay said the order board slid sequentially in April, and we expect the backlog to contract as we move through late spring and early summer, but the yet-to-be-determined date for opening the 2023 order boards will reverse the backlog contraction and likely quickly extend the backlog well into next year.

The Trucker News Staff produces engaging content for not only TheTrucker.com, but also The Trucker Newspaper, which has been serving the trucking industry for more than 30 years. With a focus on drivers, the Trucker News Staff aims to provide relevant, objective content pertaining to the trucking segment of the transportation industry. The Trucker News Staff is based in Little Rock, Arkansas.