U.S. sales of new Class 8 trucks continued their strong pace in February as OEMs reported sales of 20,136 trucks. This total is second only to the year 2006 for the best February ever, according to data received from Wards Intelligence.

The February total was just 234 trucks higher than January’s 19,902 for an increase of 1.2%. When compared with February 2022, however, the increase was more than a third higher at 35%. Last February, 14,916 trucks were sold.

North American orders for new Class 8 equipment continued to pour in during February, supporting assumptions that freight will hold steady despite rumblings of a coming recession.

According to ACT Research, preliminary net orders were 23,600 — up 27% from January and up 13% from February 2022 orders. Final numbers weren’t in as of press time but are expected to be close to the preliminary report. ACT had been expecting orders in the 15,000-20,000 range.

“Thus, February’s SA (seasonally adjusted) 22,400 represents a modest upside to our expectation,” said Eric Crawford, vice president and senior analyst at ACT. “Combined with January, SA orders have averaged 19,700 units year to date.”

ACT also reported robust orders for new trailers, with 24,300 reported for January. A Feb. 20 release titled “U.S. Trailer Industry Already Committed Through Most of 2023” indicated that, if orders were to stop today, it would take the industry until nearly year-end to build the trailers already on order. Some of those orders could be to replenish dealer stocks, which have been low for a year or more now.

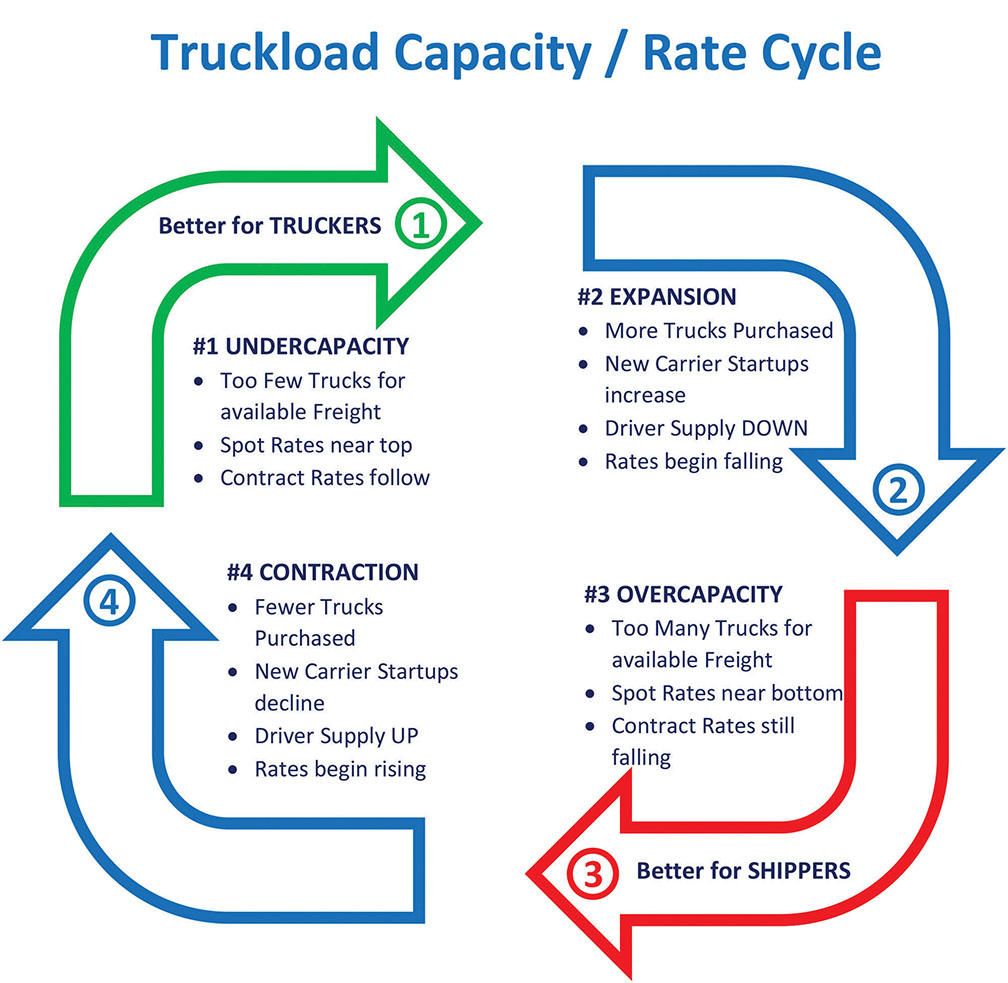

The latest purchasing and ordering activity creates some confusion in the “Truckload Capacity/Rate Cycle” shown in the diagram here. Bottoming spot freight rates, falling contract rates and a decline in new carrier registrations indicate the truckload industry should be contracting as shown in Quadrant 4 of the diagram. The market correction usually would be to order fewer trucks.

However, the trucking industry is still buying trucks at a high rate — and ordering more, as if correcting for the condition shown in Quadrant 1. Despite worsening conditions, large carriers are still making money, and are anticipating they will continue to do so for the near future. Smaller carriers — many of them single-truck operations that depend heavily on spot rates — are finding it more difficult to operate.

A recession, if one occurs at all, would likely curtail truck buying and push the industry into Quadrant 4, contraction. Inflation, however, may have a large impact. Inflation occurs as the economy grows, so higher inflation indicates a fast-growing economy — and a growing economy produces more freight.

If the economy continues to expand, the condition of too many trucks for the available freight could solve itself, a factor carriers are considering as they place orders for more equipment.

In new U.S. truck sales, International claimed the largest year-over-year increase by percentage, reporting February sales of 2,828 new trucks compared to 1,514 in February 2022 for an increase of 86.8%. Compared to January 2023, International’s February sales were up 15%.

For the year to date, International sales have been good for 13.2% of the new Class 8 market, up a little from the 12.5% market share for the full year of 2022. As recently as 2009 the company had bested Freightliner as the top seller, bringing in 28% of the U.S. market compared to Freightliner’s 27.3%. With emissions issues behind them and now under the ownership of the Traton Group, who also owns MAN, Scania and RIO brands, more trucks on the highway might be wearing International nameplates in the future.

For now, Freightliner still reigns as the Class 8 leader. The company reported sales of 7,368 in February, down 21.7% from January sales of 9,404 but a 25.1% increase over February 2022 sales of 5,891 trucks. Freightliner accounted for 37.9% of the Class 8 trucks sold on the U.S. market in 2022, within a point of where the manufacturer has been for the past decade.

Volvo rode the good times for truck sales with a report of 2,366 new Class 8 trucks sold in February — a whopping 68.4% higher than January’s 1,405 sold. Compared with February 2022, sales grew by 45.6%. Volvo-owned Mack also saw a good month, reporting sales of 1,344 new Class 8 trucks compared to 989 in January for an increase of 35.9%. Compared with February 2022, sales were up by 36.7%. Mack’s share of the U.S. Class 8 market so far this year is 5.8%, while Volvo’s is 9.4%.

Kenworth reported sales of 2,843 in February, 8.8% better than January’s 2,614. Compared with February 2022, sales increased 34.2% from 2,118 a year ago. Interestingly, Peterbilt reported exactly the same sales number for February with 2,843 sold, a 15.6% increase over January and a 22.2% increase over February 2022 sales of 2,327. Kenworth holds 13.6% of new Class 8 truck sales so far in 2023 while Peterbilt claims 13.2%

Western Star is the smallest of the road truck manufacturers, reporting 534 sold in February. That’s down 5.8% from January’s 567 but 16.6% higher than February 2022, when 458 trucks were sold. So far company has 2.7% of the new Class 8 truck sales in 2023, equal to its market share for the whole of 2022.

An interesting note in the February report is that Tesla reported sales of 10 of its battery-electric trucks during the month, after registering on the Wards report for the first time in January with sales of 30 units. The 40 trucks sold year to date represent just under a tenth of one percent of the Class 8 trucks sold on the U.S. market so far in 2023, a number that will undoubtedly grow in the future. Other manufacturers of battery and/or fuel cell electric trucks will eventually be counted in the totals.

If the predicted recession is mild, the trucking industry could see a quick return to favorable conditions and more expansion, with even higher sales of new trucks and other equipment.

Cliff Abbott is an experienced commercial vehicle driver and owner-operator who still holds a CDL in his home state of Alabama. In nearly 40 years in trucking, he’s been an instructor and trainer and has managed safety and recruiting operations for several carriers. Having never lost his love of the road, Cliff has written a book and hundreds of songs and has been writing for The Trucker for more than a decade.