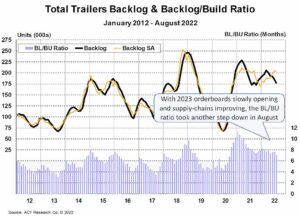

COLUMBUS, Ind. — August net U.S. trailer orders of 17,777 units were 4.6% higher compared to last month, but more than 37.7% above last year’s August level, according to this month’s issue of ACT Research’s State of the Industry: U.S. Trailers report.

“Discussions across the past month indicate more OEMs opening 2023 build slots (some opening initial slots, others expanding into later in the year),” said Jennifer McNealy, director of commercial vehicle market research & publications at ACT Research. “OEMs continue to negotiate with fleets, and those efforts are quickly moving to booked business.”

ACT Research’s State of the Industry: U.S. Trailers report provides a monthly review of the current U.S. trailer market statistics, as well as trailer OEM build plans and market indicators divided by all major trailer types, including backlogs, build, inventory, new orders, cancellations, net orders and factory shipments. It is accompanied by a database that gives historical information from 1996 to the present, as well as a ready-to-use graph packet, to allow organizations in the trailer production supply chain, and those following the investment value of trailers, trailer OEMs and suppliers to better understand the market.

“While manufacturers continue to wrestle with rolling supply-chain disruptions, as well as challenges on the labor front, tangible improvements are being made,” McNealy said. “OEMs are investigating longer-term supply solutions, including but not limited to increased parts inventories and automation to offset labor pains, in hopes of getting ahead of potential future disruptions. Demand remains strong, cancellations remain insignificant as fleets in queue plan to stay in line, and we’re beginning to hear about price stabilization accompanying the smoother flow of materials in the supply chain.”

The Trucker News Staff produces engaging content for not only TheTrucker.com, but also The Trucker Newspaper, which has been serving the trucking industry for more than 30 years. With a focus on drivers, the Trucker News Staff aims to provide relevant, objective content pertaining to the trucking segment of the transportation industry. The Trucker News Staff is based in Little Rock, Arkansas.