COLUMBUS, Ind. — August preliminary net trailer orders see a slight rise in August as compared to July.

“Sequentially, higher August net order intake was expected, as the annual cycle begins to move toward stronger order months at the end of Q3 when the industry begins opening next year’s order boards,” said Jennifer McNealy, director CV market research and publications at ACT Research. “August’s tally brings the year-to-date net order total to 109.8k units, about 23% better than the same eight-month order intake of 2024. Looking forward, concern continues that moderating economic activity, ongoing weak for-hire carrier profitability, and ambiguous policy shifts remain as challenges to stronger trailer demand. Ongoing near-term uncertainty is why ACT’s expectations for subdued build and lackluster order intake levels during 2025 remain intact. Simply put, there isn’t enough impetus in the current hesitant environment to support a more robust outlook.”

Minute Increase

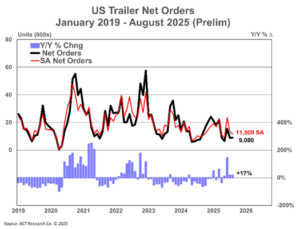

Preliminary net trailer orders in were little more than 250 units higher than July’s 8,800 level, a 3% month-to-month increase. At 9,000 units booked in August, order intake was 17% above last August’s level. Seasonal adjustment (SA) at this point in the annual order cycle remains favorable, raising August’s tally to 11,500 units. Final August results will be available later this month. This preliminary market estimate is typically within ±5% of the final order tally.

“Additionally, preliminary data show cancel rates remain elevated, albeit at a tamer level in August, at around 1.9% of the backlog, compared to the 4.2% of backlog reported in June,” McNealy said.