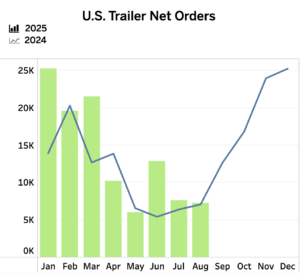

BLOOMINGTON, Ind. — FTR is reporting U.S. trailer net orders totaled 7,261 units in August, down 4% month-over-month (m/m) but up 3% year-over-year (y/y).

“With builds continuing to outpace new orders, OEMs face mounting pressure to balance production against a thinning pipeline,” said Dan Moyer, senior analyst, commercial vehicles, FTR. “Unless order activity strengthens with the opening of 2026 order boards, the industry may confront additional headwinds heading into next year.

Orders Well Below Average

Despite the slight annual gain, orders remain well below the 10-year August average of 17,568 as freight weakness, tariff pressures, and pricing uncertainty continue to weigh on demand. Cancellations eased to 16% of gross orders, down from May’s peak (39%) but still slightly above long-term norms, keeping order activity suppressed.

For the full 2025 order season (September 2024-August 2025), net orders totaled 188,519 units, down 5% y/y. For 2025 to date, however, net orders are up 28% y/y at 110,080 units, averaging just over 13,750 per month. This strength reflects backloaded orders following the November 2024 election, which inflated activity in the first quarter of the year.

Trailer production decreased slightly in August as builds declined 5% m/m and 6% y/y to 17,134 units. Year-to-date (YTD) output contracted 22% y/y at 133,851 units, averaging 16,731 per month. Backlogs fell to 81,926 units (-11% m/m; -7% y/y), lowering the backlog/build ratio to 4.8 months – the weakest since June 2020.

“For trailer manufacturers and their suppliers, tariffs are producing costs, tighter margins, and increased risk of consolidation,” Moyer said. “Larger, integrated players are more resilient, while smaller firms are vulnerable. Many fleets are delaying replacements, relying more on used trailers and curbing expansion. The 2026 order season may start later than September for some OEMs with subdued bookings as policy uncertainty and structurally higher costs weigh on demand.”