BEAVERTON, Ore. — Spot truckload rates remained near all-time highs during the week ending May 3, one year after bottoming out as U.S. economies closed during the pandemic., according to a report from DAT Freight & Analytics.

The seven-day average line-haul rate for dry vans was $2.27 a mile for the week, 95 cents higher than the same period one year ago (line-haul rates exclude a fuel surcharge). Spot refrigerated freight averaged $2.61 per mile, up 94 cents compared to the same week a year ago. The average flatbed rate was $2.62 per mile, a 93-cent increase year over year and 30 cents higher than the same period in 2018, when flatbeds rates were at their previous peaks.

With a fuel surcharge, the national average spot van rate was $2.68 a mile during the first three days of May. The reefer rate was $3.10 per mile, and the flatbed rate $3.02.

Trends to watch

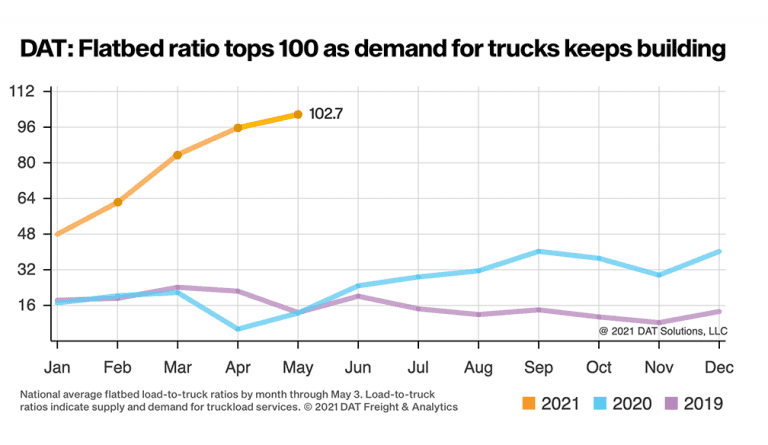

- There are more than 102 flatbed loads for every available truck.

Flatbed load post volume on the DAT network increased 3% week over week, while the number of available trucks fell 7%. The flatbed load-to-truck ratio topped 100 for the first time this year to reach 102.7, meaning there were more than 102 available flatbed loads for every available truck on the DAT network. The number of loads was more than four times higher than the same week last year, and 21% higher than the highest level reached in 2018.

- Rates rose despite lower volume.

In the 10 largest flatbed markets, the rate increased by 18 cents per mile on average compared to the previous week, despite a 7% decline in available loads. In Houston, flatbed volume was down 5% week over week, yet the average outbound spot line-haul rate increased 17 cents to $2.70 per mile.

- Dry van volume increased 5%.

The number of van loads on the DAT network increased 5% during the week ending May 3 as shippers cleared their docks of month-end freight. Truck posts dropped by the same amount, leaving the van load-to-truck ratio largely unchanged at 4.9. The average line-haul rate for dry van freight was $2.27 per mile last week, up 3 cents compared to the previous week.

- Van rates declined in large markets.

At $2.45 per mile, the average spot rate in the 10 largest van markets fell 1 cent, although the number of available loads was up 2%. Atlanta was the top market for available van loads, as volume increased 9% compared to the previous week.

- Reefer load posts increase 11%.

After falling for the previous three weeks, the national average reefer load-to-truck ratio increased to 10.7 loads per truck. The number of available reefer loads was up 11% last week and capacity tightened with 6% fewer trucks posted.

- Mother’s Day shipments were in bloom.

Mother’s Day is May 9, and the National Retail Federation said U.S. consumers plan to spend an average of $220.48 on gifts and other items for a total of $28.1 billion. Using NAICS (North American Industry Classification System) codes to convert retail revenue into tons, Mother’s Day spending equates to around 150,000 truckloads using $12,000 per ton as a rough guide.

In the two weeks leading up to May 9, roughly 70 truckloads per day head north from Miami where 80% of all floral volume is handled by just three carriers. Last week, outbound reefer volume from Miami was up 31%. On the heaviest lanes, including New York City, three-day spot line-haul rates averaged around $3.70 mile last week; Miami to Chicago averaged $2.74 per mile; Miami to Atlanta averaged $2.77 per mile; and Miami to Los Angeles averaged $1.86 per mile excluding fuel.

The Trucker News Staff produces engaging content for not only TheTrucker.com, but also The Trucker Newspaper, which has been serving the trucking industry for more than 30 years. With a focus on drivers, the Trucker News Staff aims to provide relevant, objective content pertaining to the trucking segment of the transportation industry. The Trucker News Staff is based in Little Rock, Arkansas.

The low rates and the insurance problem in Ont Canada caused 10,000 trucks to be parked or scraped between Jan and July of 2020. A large number of owner ops are living in homeless shelters after get sick in Ontario. The lack of gov action 15= months ago made this truck driver shortage. I was camped out at Queen’s park from Jan 24 to March 17 protesting along with many other people and the Ont gov did nothing. The lack of medical care in Ontario Canada is a disaster.