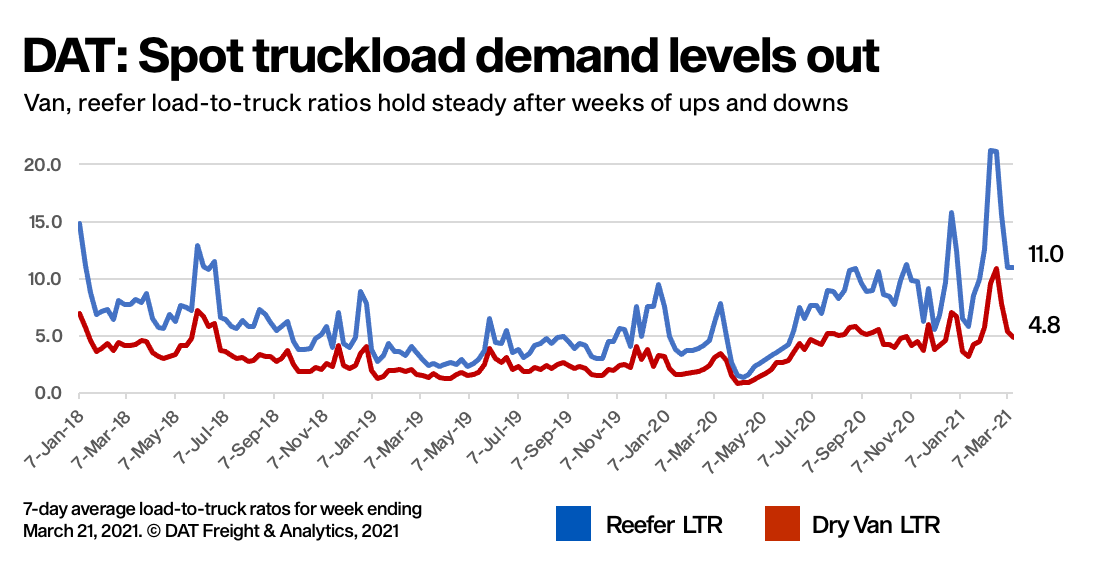

BEAVERTON, Ore. — Truckload van and refrigerated freight volumes leveled off while the flatbed load-to-truck ratio jumped sharply the week ending March 21, according to DAT Freight & Analytics. The total number of loads posted increased 0.7% and the number of trucks dipped 1.3% week over week. Rates held steady for van and reefer freight, while flatbed pricing reflected strong demand for trucks.

For the national average spot rates in March, vans were $2.68 per mile, 28 cents higher than the February average. Flatbeds were rated at $2.73 per mile, up 17 cents from last month, and refrigerated were rated 25 cents higher for $2.95 per mile.

These include a calculated fuel surcharge. The national average price of diesel was $3.19 a gallon the week ending March 21, up 1.6% week over week.

Flatbed load post volumes continue to build as construction activity and manufacturing pick up. The national average flatbed load-to-truck ratio was up from 77.6 to 86.5 the week ending March 21, and the average spot rate increased on 41 of DAT’s top 78 flatbed lanes by volume. Twenty-three lanes were neutral, and 14 lanes declined compared to the previous week.

The country’s highest-volume flatbed lane during the week was Lakeland, Florida, to Miami, averaging $3.13 a mile, down 2 cents week over week. That’s better than the average outbound rate from Lakeland, $2.42 a mile. Houston to Dallas averaged $2.77 a mile, up 11 cents compared to the previous week and 14 cents higher than the average outbound rate from Houston. Los Angeles to Phoenix jumped 9 cents to $3.40 a mile, while Phoenix to Ontario was up 20 cents to $2.70 a mile.

While rates are high for the time of year, data indicates a plateau in demand for trucks. Rates were lower on 55 of DAT’s top 100 lanes and higher on 24 lanes, and overall volume on those 100 lanes was up just 1% week over week. The national average van load-to-truck ratio fell from 5.4 to 4.8.

The spot van rate from Los Angeles to Stockton, California, averaged $3.60 a mile for the week, 5 cents more than the previous week and up 24 cents compared to the last week of February. For all outbound loads, Los Angeles averaged $3.27 a mile, down 5 cents compared to the previous week. Allentown, Pennsylvania, to Boston, Massachusetts, averaged $4.98 a mile and has lingered around $5 for the last four weeks. The jump in rates from Memphis, Tennessee, to Charlotte, North Carolina, outpaced all major van lanes with an increase of 23 cents to $3.41 a mile for the week. Memphis averaged $3.35 a mile outbound for spot van freight.

The number of loads moved on DAT’s top 72 reefer lanes by volume was up 2.7% compared to the previous week. The average rate was higher on 36 of those lanes, neutral on 16 and lower on 20 lanes.

California continues to drive the reefer market, with Los Angeles outbound averaged $3.88 a mile on a 4.7% increase in volume compared to the previous week while Ontario averaged $3.63 per mile on 8.7% more volume. Stockton averaged $3.22 a mile, a 13-cent increase week over week on 6.7% more volume.

Two major ports for temperature-controlled goods, Philadelphia, Pennsylvania, and Elizabeth, New Jersey, are producing strong rates to Boston, Massachusetts. Elizabeth to Boston averaged $6.05 a mile, a 15-cent increase week over week, while Philadelphia to Boston averaged $5.24 a mile, up 10 cents on similar volume. Atlanta to Lakeland, Florida, averaged $3.88 a mile, a 10-cent increase compared to the previous week. Load volumes from Tucson, Arizona, tumbled 7%, and the average outbound spot rate fell 13 cents to $2.86 a mile.

National average spot rates are derived from DAT RateView, a database of $110 billion in actual market transactions and 249 million freight matches each year.

The Trucker News Staff produces engaging content for not only TheTrucker.com, but also The Trucker Newspaper, which has been serving the trucking industry for more than 30 years. With a focus on drivers, the Trucker News Staff aims to provide relevant, objective content pertaining to the trucking segment of the transportation industry. The Trucker News Staff is based in Little Rock, Arkansas.