It’s a sunny day in Fort Worth, Texas. A driver pulls up to a diesel island at a favorite interstate truck stop and swipes a company fuel card. As $800 worth of diesel fuel slowly fills the tanks, the transaction seems perfectly normal.

Appearances, however, can be deceiving.

It might be weeks before the carrier notices something strange about the driver’s fuel card statements. The fuel card was, as expected, used to pay for diesel along the driver’s regular route across the southern tier of the U.S. However, it also filled the tank in places like New York and Iowa. Before long, accountants handling fuel payments for the carrier realize the driver has been a victim of fuel card skimming.

“The actual cost of fraud for trucking is unclear, but agencies have stated it’s millions of dollars each month,” said Spencer Barkoff,

co-founder and president of Relay Payments.

The problem is growing.

“Overall, the FBI reports an increase of 700% of card skimming at all businesses in the first six months of 2022,” he continued.

A fleet of 100 trucks might pay $20,000 a month in fraudulent charges. However, the impact of these charges goes beyond the company’s financial bottom line.

“Additional costs include the operational headaches that fleets and drivers face when they are the victims of card skimming,” Barkoff said.

Drivers are grounded because they’re unable to pay for fuel. Deliveries are delayed. Drivers have fewer available hours of service. And the carrier provides poor customer service.

“Dealing with the aftermath of fraud, such as identifying and disputing fraudulent transactions and submitting claims is burdensome,” Barkoff said, noting that it complicates cash flow and back office operations for fleets.

“We have one fleet customer whose CEO had to drive to meet a driver and physically hand them a new credit card after their existing billing card was closed due to card skimming fraud,” he said. “It’s a logistical and cash flow nightmare.”

Barkoff explains how fuel card skimmers operate.

“Card skimming involves the use of illegal devices that steal credit or debit card information from unsuspecting individuals,” he said. “Skimmers are installed on ATM machines or fuel pumps, and they capture sensitive data when a driver swipes a card.”

Because fuel cards are a primary form of payment in the trucking industry, truck drivers are particularly vulnerable to card skimming.

“Card skimmers collect the information to create dummy fuel cards, make fraudulent fuel purchases with those cards, and resell fuel for their own personal profit,” Barkoff said.

Carriers and fuel-card issuers often set daily spend caps to limit fraud risk, but scammers have various ways of working around these measures.

So, how can carriers and drivers fight fuel card skimming?

Richard Sullivan, a consultant with the Truckload Carriers Association (TCA), says a primary method is education. Sullivan has worked with the North Carolina Attorney General’s office to develop materials to educate fleet operators, drivers, and law enforcement about fuel card skimming, the complicated process, and the multiple crimes being committed.

“Law enforcement will arrest someone for using a skimmed card, but they seldom hold those responsible,” Sullivan said, “Law enforcement doesn’t understand the enormity of the fraud taking place. A series of criminal actions are involved.”

Scammers create a device solely for the purpose of skimming sensitive information and then install it inside or on a fuel pump. Then, using trucks illegally retrofitted with bladder tanks that hold 250 to 500 gallons, they purchase fuel using the skimmed cards. These bladder tanks are unregulated, and they’re dangerous; static electricity can easily create explosions.

Later, the trucks deliver the fuel to a central hub, where it is sold on the black market. No taxes are collected, so the merchant, fleet, driver, and government are all subjected to fraud. It’s a complicated network that is operated by cartels.

“The simplest solution — and one that truck stops are advocating for — is using digital payment methods to pay for fuel,” Barkoff noted. “With no physical card, there’s no opportunity for card skimming.”

This solution can benefit truck stops because they don’t have to spend revenue and handle the back-office issues created by skimming.

“Carriers and drivers also benefit, dealing with far fewer hassles and saving time and money as a result,” Barkoff said.

“With no card, there’s no magnetic swipe, and thus no card skimming,” he continued. “There’s also no opportunity for other forms of card fraud, because the digital solution relies on one-time payment codes that don’t have to be tied to any credit card as a form of payment.”

Until digital or some other fraud-proof payment system gain widespread use, what can the average driver do to protect against fraud?

The TCA recommends that drivers look at the card slot on the diesel pump. One that’s been fitted with a skimming device will often look different than slots on nearby fuel dispensers. Drivers should also take notice of broken inspection seals on the fuel dispensers. These can mean that the dispenser has been opened, allowing someone to attach a skimmer inside the machine.

In addition, drivers should use the fuel pumps closest to the entrance of the truck stop when possible. Skimmers are most likely to work the pumps farthest from the building, so they won’t be noticed installing their devices. Finally, if a driver has repeated problems with a transaction or receives error codes, the issue should be reported to dispatch immediately.

As for the future of fuel card skimming, Barkoff says the industry can’t let its guard down anytime soon.

“Criminals are creative, and have found countless ways to steal credit card information,” he noted. “Those who continue to rely on modes of payment such as credit cards, checks, and cash will face more instances of card skimming.”

He believes digital payments are becoming better options and that more companies will invest in non-magnetic swipe methods of payment in the future.

“The good news is that many carriers, drivers, and merchants are waking up to the issue and have begun to digitally transform with digital payment solutions,” Barkoff said.

This article originally appeared in the January/February 2024 edition of Truckload Authority, the official publication of the Truckload Carriers Association.

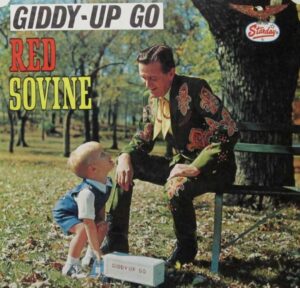

Since retiring from a career as an outdoor recreation professional from the State of Arkansas, Kris Rutherford has worked as a freelance writer and, with his wife, owns and publishes a small Northeast Texas newspaper, The Roxton Progress. Kris has worked as a ghostwriter and editor and has authored seven books of his own. He became interested in the trucking industry as a child in the 1970s when his family traveled the interstates twice a year between their home in Maine and their native Texas. He has been a classic country music enthusiast since the age of nine when he developed a special interest in trucking songs.