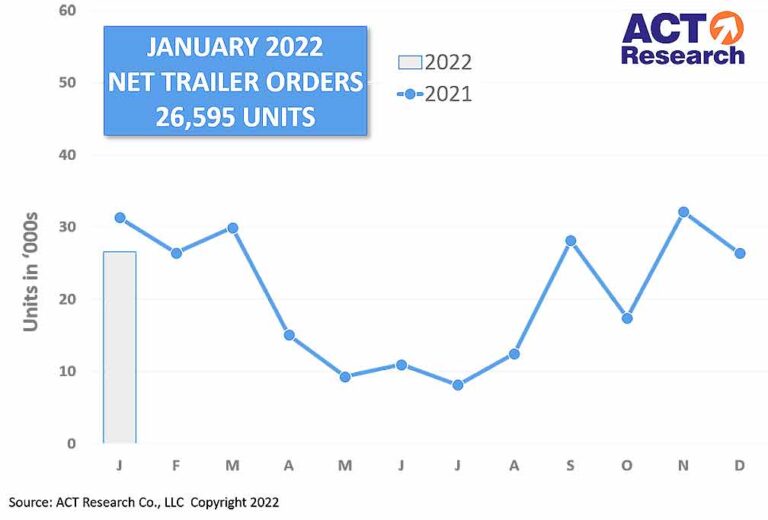

COLUMBUS, Ind. — January net US trailer orders of 26,595 units increased less than 1% from the previous month and were more than 15% lower compared to January of 2021.

Before accounting for cancellations, new orders of 28.0k units were down about 2% versus December, and almost 15% lower than the previous January, according to this month’s issue of ACT Research’s State of the Industry: U.S. Trailer Report.

ACT Research’s State of the Industry: U.S. Trailers report provides a monthly review of the current US trailer market statistics, as well as trailer OEM build plans and market indicators divided by all major trailer types, including backlogs, build, inventory, new orders, cancellations, net orders, and factory shipments.

It is accompanied by a database that gives historical information from 1996 to the present, as well as a ready-to-use graph packet, to allow organizations in the trailer production supply chain, and those following the investment value of trailers, trailer OEMs, and suppliers to better understand the market.

“The effort that OEMs have made to prevent untenable backlog growth through controlling order acceptance continues. That effort has been highly driven through dry vans and reefers,” Frank Maly, director of commercial vehicle transportation analysis and research at ACT Research, said. “Expect the conservative order acceptance stance to continue for the near term; until meaningful production increases can be implemented, this will be status quo. Allocation of production between fleets and dealers will continue to be the norm, with dealers, and correspondingly their small to medium fleet customer base, likely more significantly challenged.”

Maly said a there was a slight increase in backlog and a slight decrease in production rates.

“Those calculate to a slight increase in backlog-to-build at the close of January,” Maly said. “The 8.3-month level for total trailers commits the industry into very early Q4 of 2022 at current build rates, and this is the highest level since last June. We would expect this metric to remain stubbornly high, and it could also be approaching the Christmas timeframe sometime in Q2, projecting an early calendar-year 2022 sell-out.”

The Trucker News Staff produces engaging content for not only TheTrucker.com, but also The Trucker Newspaper, which has been serving the trucking industry for more than 30 years. With a focus on drivers, the Trucker News Staff aims to provide relevant, objective content pertaining to the trucking segment of the transportation industry. The Trucker News Staff is based in Little Rock, Arkansas.