PORTLAND, Ore. — With most of the country in a heat wave, spot truckload rates wilted during the week ending July 21, said DAT Solutions, which operates the industry’s largest network of load boards.

Load-posting volume on the DAT network slipped 16% while the number of trucks posted rose 3%. National average spot rates were negative compared to the previous week but still within mid-July expectations.

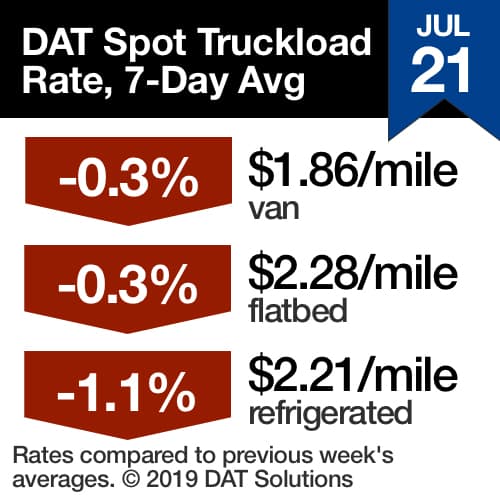

National Average Spot Rates through July 21 were:

- Van: $1.86/mile, 3 cents lower than the June average

- Reefer: $2.21/mile, 5 cents lower than June

- Flatbed: $2.28/mile, 2 cents lower than June

Van trends

For truckers, pricing power slumped in most major markets, including Los Angeles ($2.27/mile, down 4% over the past four weeks) and Atlanta ($2.07/mile, down 5% over four weeks). Rates were higher on just 20 of the DAT Top 100 van lanes, and some of the stronger gains were on lanes where rates are generally low anyway:

- Columbus, Ohio, to Atlanta, up 10 cents to $1.98/mile

- Denver to Stockton, Calif., up 11 cents to $1.24/mile

Van volumes are sliding in the Southeast. Houston averaged $1.77/mile, 3 cents lower than the previous week. With Texas oilfield production down, demand for van freight in outlying markets has slowed.

Reefer trends

Reefer volumes and rates continue to fall, with the load-to-truck ratio dropping from 3.8 to 3.2 last week. Volumes increased slightly in the Midwest but not enough to make up for declines in the rest of the country. Rates out of Sacramento, California, and McAllen, Texas, held up better compared to most markets, and two Midwest lanes stood out:

- Green Bay, Wisconsin, to Des Moines, Iowa, up 35 cents to $2.85/mile

- Grand Rapids, Michigan, Cleveland, up 15 cents to $3.30/mile

Key takeaways

- Low volumes and rates are pushing reefer carriers into the spot van market, causing a drag on rates

- National average rates are still higher than May, a positive sign for the middle of July

- However, load-posting volume declined sharply at the end of last week; activity could stabilize and rates still may slip further this week

DAT Trendlines is a weekly snapshot of month-to-date national average rates from DAT RateView, which provides real-time reports on spot market and contract rates, as well as historical rate and capacity trends. The RateView database is comprised of more than $65 billion in annualized freight payments. DAT load boards average 1.2 million load searches per business day.

For the latest spot market loads and rate information, visit www.dat.com/trendlines and follow @LoadBoards on Twitter.

The Trucker News Staff produces engaging content for not only TheTrucker.com, but also The Trucker Newspaper, which has been serving the trucking industry for more than 30 years. With a focus on drivers, the Trucker News Staff aims to provide relevant, objective content pertaining to the trucking segment of the transportation industry. The Trucker News Staff is based in Little Rock, Arkansas.