BEAVERTON, Ore. — Amid record freight volumes for the time of year, national average spot truckload van and refrigerated rates swung back up to early January levels during the week ending Feb. 28, according to DAT Freight & Analytics, which operates the industry’s largest load board network.

The number of load posts on the DAT network was 24% higher and truck posts increased 11% compared to the previous week. Intermodal network disruptions pushed more freight into the spot markets as shippers sought to meet delivery deadlines with customers.

For the month of February, load postings were up 162% compared to February 2020, when supply chains began to experience imbalances in demand due to COVID-19.

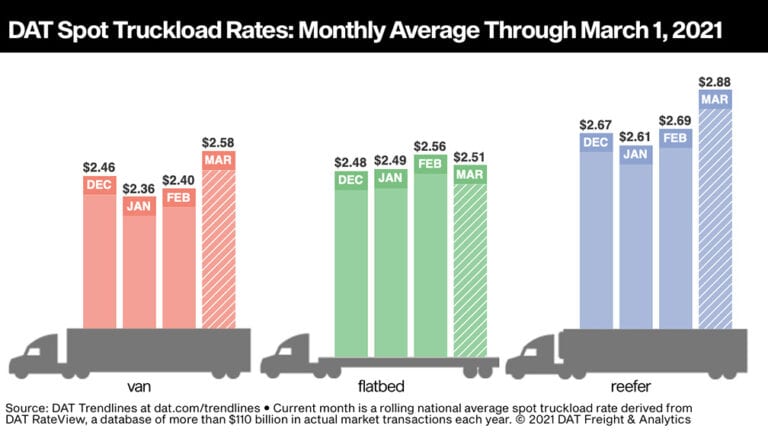

National average spot rates for February, which include a calculated fuel surcharge, were $2.40 per mile for van, $2.56 per mile for flatbed and $2.69 per mile for refrigerated. Van and reefer pricing entered March much higher than these February averages. On March 1, the national average van rate was 18 cents higher at $2.58 per mile; the reefer rate was up 19 cents at $2.88.

Trendlines

Van volumes surge

Dry van load post volumes surged 28% last week as supply chains continue to recover from a month of difficult weather. Truck posts increased 22% compared to the previous week, returning to more seasonal levels. The van load-to-truck ratio averaged 10.9 last week, up from 9.6 the previous week. The average ratio in February was 7.5, up from 1.8 in February 2020.

The average spot van rate was higher on 91 of DAT’s top 100 van lanes by volume last week. Volume in those lanes increased 26.6%.

Texas-bound loads increase

Compared to the previous week, there was a 53% increase in load post volumes for flatbed freight coming into Texas markets. Reefer volumes increased 28%, and van volumes were up 25%. At $2.64 a mile, the average rate from Houston to Dallas was up 24 cents, while Dallas to Houston increased 35 cents to an average of $3.26 a mile. The number of loads moved each direction increased 226% compared to the prior week, although Dallas to Houston was the far busier lane.

California keeps climbing

Outbound load volumes from Los Angeles and Ontario, California, increased 18% and 36% week over week, respectively. The average outbound rate from Los Angeles rose 23 cents to $3.07 a mile, paced by L.A. to Dallas (up 43 cents to $2.94 a mile), Stockton (up 8 cents to $3.36), Seattle (up 18 cents to $3.45), Denver (up 17 cents to $3.83), and Phoenix (up 13 cents to $3.35).

Reefer demand stays balanced

Overall spot reefer volumes were up 15% compared to the previous week, balanced by a 15% increase in truck posts. The national average reefer load-to-truck ratio was up slightly to 21.2. The number of loads moved on DAT’s top 72 reefer lanes by volume was virtually unchanged compared to the previous week. The average spot reefer rate was higher on 56 of those lanes, lower on four, and neutral on 12.

Compared to the same period in 2020, reefer load-post volume was up 306% last week. Demand for temperature-controlled equipment is exceptional for this time of year; we’re also entering a period where year-over-year comparisons will be skewed by the start of shutdowns in the U.S. due to the pandemic.

Markets in the Midwest and West heat up

Capacity continues to tighten in Twin Falls, Idaho, after a 13% increase in volume last week. The average outbound rate increased for the third week in a row, jumping 15 cents to $2.63 a mile. Volumes in this region are up 38% compared to the previous week and almost double from two weeks ago with growers reporting a shortage of trucks to haul apples, pears, onions, and potatoes, according to the USDA. A similar shortage of trucks was reported in the Imperial and Coachella valleys of California. Week over week, the average rate from Fresno gained 21 cents to $2.76 a mile, and Ontario was up 12 cents to $3.19.

Outbound spot reefer loads from Green Bay, Wisconsin, and Grand Rapids, Michigan, both averaged more than $4 a mile last week. Green Bay increased 17 cents to $4.06, and Grand Rapids was up 19 cents at $4.07.

National average spot rates are derived from DAT RateView, a database of $110 billion in actual market transactions and 249 million freight matches each year.

The Trucker News Staff produces engaging content for not only TheTrucker.com, but also The Trucker Newspaper, which has been serving the trucking industry for more than 30 years. With a focus on drivers, the Trucker News Staff aims to provide relevant, objective content pertaining to the trucking segment of the transportation industry. The Trucker News Staff is based in Little Rock, Arkansas.

Please keep in the loop and thanks for all of this great info.