BEAVERTON, Ore. — The number of available loads on the spot truckload freight market continued to slide during the week ending Jan. 24, according to DAT Freight & Analytics, which operates the industry’s largest load board network and freight data analytics service. Van prices declined on most major trucking lanes.

The national average spot rate for van and refrigerated freight is now lower than the average contract rate as price increases negotiated between carriers and shippers late last year come online and spot rates dip seasonally. The difference between spot and contract van rates was as high as 14 cents a mile in September; for reefer freight, the gap hit 20 cents a mile in November around Thanksgiving. While spot rates are strong relative to past years, higher contract pricing tends to draw capacity out of the spot market.

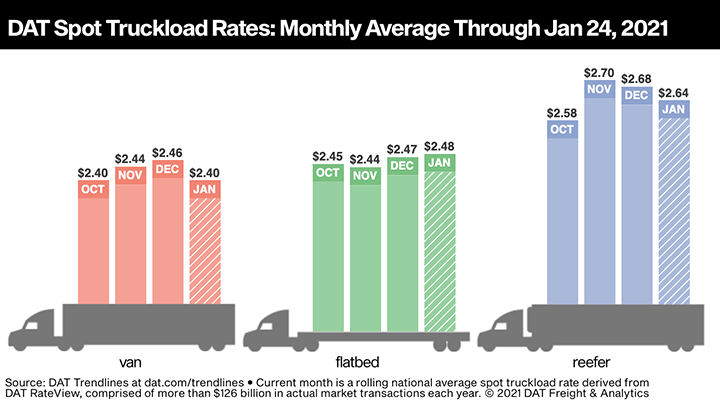

National average spot rates for Jan. 1-24, based on actual transactions negotiated between carriers and brokers or shippers were:

- Van: $2.40 per mile, 6 cents lower than the December average;

- Flatbed: $2.48 per mile, 1 cent higher than December; and

- Refrigerated: $2.64 per mile, 4 cents lower than December.

Trendlines

Fuel prices keep climbing: The average price of on-highway diesel was $2.37 per gallon to start November, the low point for the year; last week, the price averaged nearly $2.71 a gallon.

Van volume dips: Dry van load-post volume fell 12% compared to the previous week as seasonality started to set in. Less than 1% more trucks were posted, pushing the van load-to-truck ratio down from 3.6 to 3.2.

While the number of loads moved on DAT’s top 100 van lanes by volume declined by 0.7% compared to the previous week, the average spot truckload rate fell on 93 of those 100 lanes. The rate increased on just one lane and was neutral on six.

On DAT’s top 10 markets, dry van load post volumes dropped by 10% last week; spot rates fell an average of 11 cents a mile in these markets.

California correction: DAT analysts are seeing a major correction underway as spot market volumes in Southern California markets return to pre-pandemic levels. Los Angeles averaged $2.80 a mile last week, down 18 cents compared to the previous week and 31 cents lower since the first week of the year. Key lanes last week were:

- Los Angeles to Chicago: $2.23 a mile, down 48 cents since the beginning of January.

- Los Angeles to Dallas: $2.50 a mile, down 43 cents.

- Los Angeles to Atlanta: $2.31 a mile, down 48 cents.

Reefers slow: Nationally, the average reefer load-to-truck ratio dropped from 6.5 to 5.9 last week as the number of load posts fell 11% with very little change in truck posts. The number of loads moved on DAT’s top 72 reefer lanes by volume increased 10% week over week, although the average rate was lower on 67 of those lanes. Load post volumes dropped in most of the top 10 markets, however.

Domestic produce shipment fall: According to the U.S. Dept. of Agriculture, domestic truckloads of produce were down 37% year over year for the week ending Jan. 16, but up 13% year over year for imported truckloads. The decrease in domestic volumes is significant and driven by persistent, devastating conditions in the food-service business. At $659 billion, restaurant and food-service industry sales were 27% below expectations and more than 110,000 eating and drinking places closed for business temporarily, or for good, in 2020, according to the National Restaurant Association.

Florida volumes pick up: In Florida, winter produce volumes are providing backhaul opportunities for carriers that ventured into the Miami and Lakeland markets where volumes increased by 19% and 23%, respectively, compared to the previous week. Higher volumes and outbound rates in Savannah, Jacksonville, and Tifton were incentives for carriers to stay in southern Georgia, keeping capacity tighter for outbound Florida loads.

The Trucker News Staff produces engaging content for not only TheTrucker.com, but also The Trucker Newspaper, which has been serving the trucking industry for more than 30 years. With a focus on drivers, the Trucker News Staff aims to provide relevant, objective content pertaining to the trucking segment of the transportation industry. The Trucker News Staff is based in Little Rock, Arkansas.