LINCOLN, Neb. — According to new market data from Sandhills Global, used heavy-duty sleeper truck inventory on TruckPaper.com was down 22% in August compared to July.

The used inventory numbers, which correlate with changes in key value metrics including asking price per mile and inventory sold, resulted in the largest month-to-month average price increase (up 2%) since the beginning of the COVID-19 pandemic. Used heavy-duty day cab inventory experienced a similar month-to-month inventory drop (down 20%) and average unit price increase (up 3%).

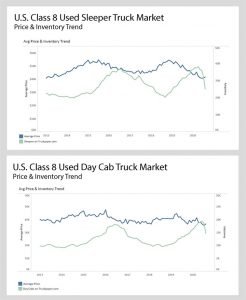

Emerging from July, the truck market was poised for recovery, according to analysts at Sandhills Global. The charts shown here illustrate how quickly inventory levels have dropped in recent months for used heavy-duty sleeper trucks and day cabs. Based on these metrics, Sandhills would expect used truck pricing to continue to increase. Trends to note include:

- U.S. Class 8 Used Sleeper Truck Market: After supply peaked in the second quarter of 2020 with 38,154 listings, used sleeper truck inventory has dropped by more than 7,000 with used inventory down to 25,095.

- U.S. Class 8 Used Day Cab Truck Market: Used heavy-duty day cab inventory has dropped by nearly 4,000 listings—from 19,362 listings early in the second quarter of 2020 to 14,758 in August.

Sandhills Global is an information-processing company that connects buyers and sellers in the construction, agriculture, forestry, oil and gas, heavy equipment, commercial trucking and aviation industries. Sandhills Used Price Index is a principal gauge of the estimated market values of used assets, both currently and over time, across the construction, agricultural and commercial trucking industries represented by Sandhills’ marketplaces.

The Trucker News Staff produces engaging content for not only TheTrucker.com, but also The Trucker Newspaper, which has been serving the trucking industry for more than 30 years. With a focus on drivers, the Trucker News Staff aims to provide relevant, objective content pertaining to the trucking segment of the transportation industry. The Trucker News Staff is based in Little Rock, Arkansas.