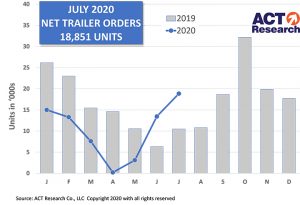

COLUMBUS, Ind. — July net U.S. trailer orders of 18,851 units were a significant improvement, up 40% from June’s uptick and well above July 2019’s level (up 80%). Before accounting for cancellations, new orders of 20,000 units were up 26% versus June and 44% better year over year, according to this month’s issue of ACT Research’s State of the Industry: U.S. Trailer Report.

“The industry continues to climb from the COVID-generated historic low order volume posted in April,” said Frank Maly, director of commercial vehicle transportation analysis and research at ACT Research. “At this time last year, however, fleets were in a freight volume and rate-driven investment retrenchment that continued through last September/October.”

ACT’s State of the Industry: U.S. Trailers report provides a monthly review of the current U.S. trailer market statistics, as well as trailer OEM build plans and market indicators divided by all major trailer types, including backlogs, build, inventory, new orders, cancellations, net orders and factory shipments.

“Our conversations this month indicate that a change in fleet attitudes began to occur in mid-June, when they began to investigate availability and pricing,” Maly said.

“Discussions following the July 4 holiday break shifted toward active negotiations and order placement,” he continued. “An interesting dichotomy for the industry was occurring at that time: As OEMs extended holiday downtime, fleets began to make investment commitments, with larger fleets leading the way and trailer order strength concentrated in the dry van segment.”

While the nation’s net trailer orders showed definite improvement, ACT’s analysis of U.S. trailer production showed scattered rebounds and predicted a lower replacement demand. According to this quarter’s issue of ACT’s Trailer Components Report, analysis of the last decade of trailer production shows that the industry opened the year at an average production pace until the shelter-in-place lockdowns began late in the first quarter of 2020.

“Although a widespread shutdown of production of both commercial trucks and autos occurred as part of the overall Q2 societal lockdowns, the commercial trailer segment continued to operate, albeit at lower rates,” Maly noted. “After remaining barely positive in April, a soft gain in net orders occurred in May. That was followed by better demand in both June and July; those months exceeded previous year levels.”

ACT’s U.S. New Trailer Components and Materials Forecast provides those in the trailer production supply chain, as well as those who invest in said suppliers and commodities, with forecast quantities of components and raw materials required to support the trailer forecast for the coming five years. It includes near-term quarterly predictions for two years, while the latter three years of the forecast are shown in annual details. Additionally, analysis is segmented into two categories — those needed for the structural composition of new trailers and those used in the production of undercarriage assembly.

“Despite better order trends, adjustments to production as we moved into summer were a foregone conclusion; the only question was timing,” Maly said, adding that scheduled holiday shutdowns in July allowed OEMS to extend planned downtime in response to low order volume.

“The recent order rebound is extremely dry van-centric, so OEMs and component and material suppliers in the dry van and reefer markets will be less impacted than those in the vocational trailer segments,” he stated. “From a timing standpoint, most of the recent order rebound will be more impactful to late Q3 and Q4 volumes.”

When asked about future trailer production, Maly said he believes that in addition to COVID-19, other factors will continue to impact trailer volumes during the coming years.

“The surge of trailer acquisitions in 2017-19 has increased trailers in operation, decreased average life of trailers in use, and more than caught up with delayed replacement of older units,” he explained. “In addition to the market impact of an economy crawling from the worst quarterly performance in history, replacement volumes will also be lower than in recent years.”

The Trucker News Staff produces engaging content for not only TheTrucker.com, but also The Trucker Newspaper, which has been serving the trucking industry for more than 30 years. With a focus on drivers, the Trucker News Staff aims to provide relevant, objective content pertaining to the trucking segment of the transportation industry. The Trucker News Staff is based in Little Rock, Arkansas.