COLUMBUS, Ind. — North America’s trucking industry continues to show signs of improvement, according to ACT Research’s State of the Industry: U.S. Trailers report for August.

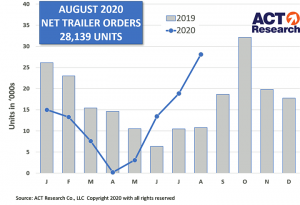

August net U.S. trailer orders of 28,139 units were a significant improvement (up 49%) from July’s uptick — and well above August 2019’s level (up 160%). Before accounting for cancellations, new orders of 29,000 units were up 46% compared to July and 96% better year over year.

“Conversations in recent months have indicated a change in fleet perspective, frequently phrased as more requests for quotes, ongoing negotiations, or a simple statement that ‘the phone is ringing a lot more lately’,” said Frank Maly, director of commercial vehicle transportation analysis and research for ACT. “That shift started in late June, and we saw a minor gain in orders in July.”

ACT’s U.S. Trailers report provides a monthly review of the current U.S. trailer market statistics, as well as trailer OEM build plans and market indicators divided by all major trailer types, including backlogs, build, inventory, new orders, cancellations, net orders and factory shipments. It is accompanied by a database that provides historical information from 1996 to the present, as well as a ready-to-use graph packet, to allow organizations in the trailer production supply chain, as well as those following the investment value of trailers and trailer OEMs and suppliers, to better understand the market.

“However, it’s still not all sunshine, as August’s orders included a substantial amount of large fleet demand, with strong e-commerce support, which bodes well for dry vans and reefers, but provides minimal benefit for vocational categories,” Maly noted.

“With large fleets seeing better volumes and rates, they may be moving with a more bullish perspective than we perceive, and while trailer OEMS welcome the interest, they are wondering if the recent order strength has ‘legs’,” he concluded.

The Trucker News Staff produces engaging content for not only TheTrucker.com, but also The Trucker Newspaper, which has been serving the trucking industry for more than 30 years. With a focus on drivers, the Trucker News Staff aims to provide relevant, objective content pertaining to the trucking segment of the transportation industry. The Trucker News Staff is based in Little Rock, Arkansas.