WASHINGTON — A series of cutbacks tied to Russia’s war in Ukraine, accidents and the slowing global economy have strained the world’s oil supply. While oil and fuel prices have dropped despite a recent supply crunch, those threats could end up pushing costs higher this winter.

What’s the world facing?

— An EU ban on imports of most Russian oil took effect last week.

— At the same time, the Group of Seven leading democracies and 27-nation EU capped the price of Russian crude for other countries at $60 per barrel.

— There was a major leak along the Keystone pipeline in the U.S., which halted oil shipments along a major corridor.

— Dozens of oil tankers were stuck in Turkey for days.

— The OPEC+ coalition of oil producers has cut back production.

“The global system can withstand probably a few more days of these outages, but if they persist, they’re going to play a major role in price hikes,” said Claudio Galimberti, senior vice president of analysis at Rystad Energy.

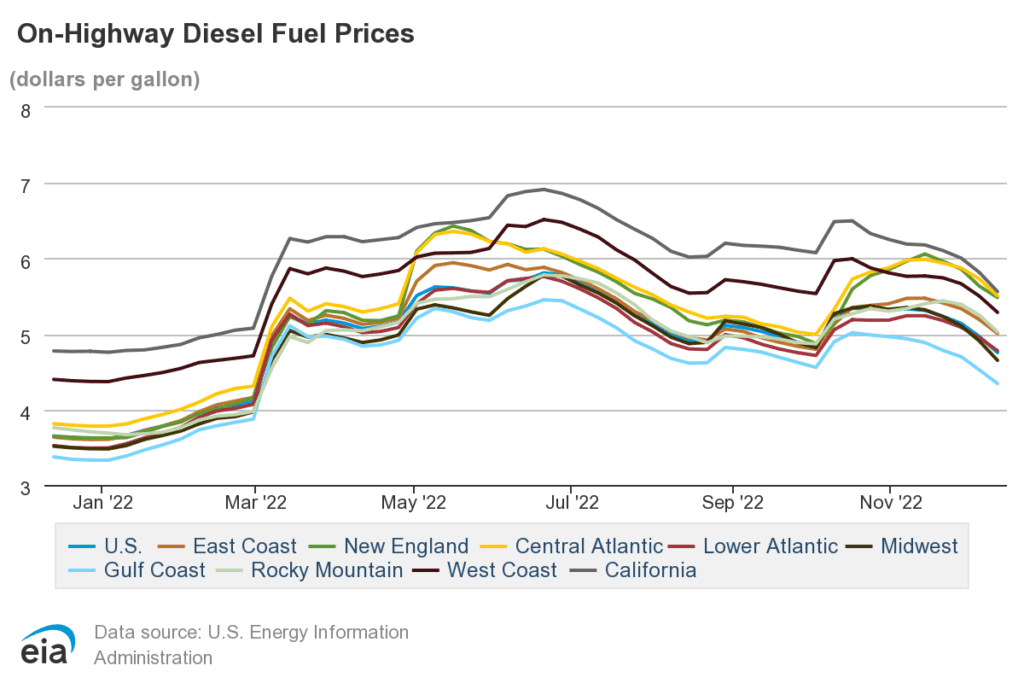

Diesel prices continue to fall — for now

Though in small increments, the average price for a gallon of diesel fuel in the U.S. has been in steady decline for more than a month.

According to the Energy Information Administration (EIA), the average price as of Dec. 12 rings up to $4.754 per gallon, down from $4.967 on Dec. 5 and $5.141 on Nov. 28. Prices have been slowing falling since Nov. 7.

Year to date, however, the average is still well above a dollar more per gallon than current averages, according to EIA statistics.

What does the future hold for big oil?

A key reason restrictions on oil supply have not sent prices higher: Traders think there will be less demand for oil in the future, due to fears that the global economy is headed into recession, which would mean less driving and manufacturing. And some investors worry China’s looser COVID-19 restrictions could backfire for the nation’s economy.

“It can quickly turn into a major COVID wave which engulfs the hospitals and then is going to have a worse effect on demand than COVID policy,” Galimberti said.

The restrictions on Russian exports are likely to have a bigger impact on oil prices next month. Although Western nations have banned Russian oil, customers in India and China are buying it, so there’s enough oil on the market for those who need it. More than 97% of Russia’s seaborne crude exports went to China and India last month, according to Refinitiv, a financial market data provider.

“We do not ask our companies to buy Russian oil. We ask them to buy oil,” Indian External Affairs Minister Subrahmanyam Jaishankar said in Parliament last week. “But it is a sensible policy to go where we get the best deal in the interest of Indian people, and that’s exactly what we are trying to do.”

In February, global oil supply could get more limited, because European nations won’t be able to buy Russian refined products such as gasoline and diesel, so Russia could cut back on producing oil.

“So far, there hasn’t been a major decline in Russian production. But once Russia cannot export products to Europe, they will need to decrease production, and that will result in a supply shortage, which will be reflected in the prices most likely,” Galimberti said.

Russia also could decide not to produce oil due to the G-7 price cap. Its oil is selling for less than that now. But if the price goes up and approaches the cap, Russia could decide to take oil off the market, analysts said.

“There’s another shoe to drop on that front,” said Kevin Book, managing director at Clearview Energy Partners.

The price cap will lock in a discount on Russian oil, especially in light of the $100 per barrel Russia earned just a few months ago, White House press secretary Karine Jean-Pierre said.

“We are focused on limiting Putin’s ability to profit from rising prices to fund his illegal war, while promoting stable global energy markets,” Jean-Pierre said. “This is not about Russian oil off the market. This is about the cap — the cap at this level maintains clear incentives for Russia to continue exporting, and we believe that it should.”

International standard Brent crude oil was selling for about $80 a barrel Friday. That’s likely to grow to $92 per barrel on average next year, according to projections by the U.S. Energy Information Administration. That is still below $125 seen this summer.

The Trucker Staff contributed to this report.

The Associated Press is an independent global news organization dedicated to factual reporting. Founded in 1846, AP today remains the most trusted source of fast, accurate, unbiased news in all formats and the essential provider of the technology and services vital to the news business. The Trucker Media Group is subscriber of The Associated Press has been granted the license to use this content on TheTrucker.com and The Trucker newspaper in accordance with its Content License Agreement with The Associated Press.