WASHINGTON – Despite challenges in recent months, there are some positive signs that the nation’s supply chain is becoming a bit less stressed, according to a recent report by the U.S. Department of Transportation’s (USDOT) Supply Chain Indicators Tracker.

The tracker is part of President Biden’s Supply Chain Disruptions Task Force.

“Since the beginning of the COVID-19 pandemic, we have seen stressed supply chains, as historic levels of goods coming into the U.S., aging infrastructure, the pandemic and geopolitical disruptions continue to cause bottlenecks, congestion and challenges in global markets,” a USDOT news release stated.

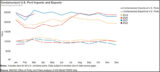

The total number of container ships waiting for berths at U.S. ports has dropped by 47% since peaking in early February, even as containerized imports increased sharply in March for most U.S. ports, according to the USDOT.

The Ports of Los Angeles, Long Beach and New York/New Jersey, collectively the top three for container volume to the U.S., imported 260,000 more containers in March versus February — a 12% increase and the all-time highest month for the Port Authority of New York and New Jersey.

Overall, U.S. ports imported nearly a half-percent more in the first quarter of 2022 than during the first three months of last year.

Early indications are this strength continued in April, as the Port of Los Angeles announced last week it estimates the port had its second-best April on record.

And real retail inventories excluding autos are at their highest levels in history and more than 8% above pre-pandemic levels.

“We remain focused on ensuring U.S. exporters are able to get their goods to market,” the news release stated. “Our attention continues to be on maintaining lower levels of long-dwelling containers at ports, particularly empty ones that could be re-loaded with U.S. products that are ready for export.”

USDOT officials said they are also closely monitoring what they call “precarious situations abroad, including in China, where lockdowns could potentially reduce imports and affect our supply chains.”

The State Department is providing the Biden administration updates from China and the Commerce Department is closely monitoring impacts to companies and American consumers, according to the USDOT.

Despite the lockdown, the Port of Shanghai remains open and the latest data show that exports from major Chinese ports were down only slightly in April compared to the previous year. Nevertheless, factory shutdowns and trucking delays in China could impact the U.S. supply chain, especially for autos and consumer electronics.

Finally, the task force recognizes industry is paying attention to the West Coast labor negotiations, which are expected to begin this week.

Both parties have recently expressed optimism about getting a deal — as West Coast longshore worker union president Willie Adams has said, “We’ve been doing this over 85 years, and we will sit down, we will get an agreement.”

TRACKER BACKGROUND

Over the course of the past year, as part of the president’s Supply Chain Disruptions Task Force, the USDOT and the Departments of Commerce and Agriculture have been part of an administration-wide effort to improve the flow of goods, make the country’s supply chains more resilient and lower prices for Americans, according to the Biden administration.

Freight and logistics supply chains are largely operated by the private sector.

To support greater transparency about the state of the nation’s transportation supply chains, last fall, the Task Force released a dashboard tracking real-time challenges and progress across four key metrics.

USDOT is continuing to track those four metrics and others to help depict a more complete picture of the current logistics and transportation state-of-play.

USDOT’s Transportation Supply Chain Indicators Tracker provides updates on key supply chain data — including measures and indicators of intermodal throughput such as volumes of U.S. imports and exports, transportation labor numbers, the number of container ships anchored and loitering near U.S. ports, and more.

IMPORTS AND EXPORTS

- There has been a sustained increase in containerized imports to U.S. ports.

- Increased container import volume has been observed at many ports, compared to pre-pandemic levels.

SHIPS AND CONTAINERS

- Monitoring the number of ships waiting for berths at U.S. ports, and the rate at which imported containers move inland from the ports, can help measure disruptions in supply chains, including at original port of call, port of destination, and inland modes.

- In late 2021 and early 2022, the number of container ships waiting for a dock at a U.S. port more than doubled, peaking at more than 150 in early February. Levels have declined since then, but are still higher than historical levels for many ports.

- In late October 2021, the Ports of Los Angeles and Long Beach, which account for around 37% of all U.S. containerized imports, announced intentions to levy fees on long dwelling containers. Since that time, nearly 70,000 fewer are dwelling more than 9 days or more on the ports—a 53% improvement.

WORKFORCE

- Monitoring job openings and employment trends across the sector helps understand how labor capacity may impact supply chain fluidity.

- In 2021, job openings increased substantially, outpacing a slight increase in hiring, in the Transportation, Warehousing, and Utilities sector.

- As of April 2022, the trucking industry has recovered more than 50,000 workers since one year earlier, and sits at around 40,000 higher than at start of the pandemic.

RAIL

- Measuring and monitoring intermodal units moved by rail helps identify capacity constraints on U.S. railroads and potential stresses to U.S. supply chains, overall.

- Intermodal movements by freight rail have generally trended at or above pre-pandemic (2019) levels.

- Terminal dwell times for railcars have risen since spring of 2021 for most Class I railroads.

NON-TRANSPORTATION SUPPLY CHAIN INDICATORS

- Retail inventories excluding autos were more than 8% above pre-pandemic levels at the end of March. Higher frequency data from grocery and drug stores show that the share of products that were in stock was 90% the week ending May 1, 2022, compared to 91% the week ending February 23, 2020.

The Trucker News Staff produces engaging content for not only TheTrucker.com, but also The Trucker Newspaper, which has been serving the trucking industry for more than 30 years. With a focus on drivers, the Trucker News Staff aims to provide relevant, objective content pertaining to the trucking segment of the transportation industry. The Trucker News Staff is based in Little Rock, Arkansas.