MIAMI — Ryder System Inc. has reported results for the three months ended Sept. 30.

Ryder Chairman and CEO Robert Sanchez offered an overview of what the successful third quarter means for the company and its shareholders.

“Our strong third quarter performance and increased 2023 guidance demonstrate the ongoing effectiveness of our balanced growth strategy despite a challenging freight environment,” he said. “ROE (return on equity) of 21% remained above our high-teens target and all three business segments achieved their pre-tax earnings targets during the quarter.”

Sanchez added that “the transformative changes we’ve made to de-risk the business model, enhance returns and drive profitable growth are contributing to our significant outperformance versus prior cycles and are providing us with additional opportunities to increase shareholder value. Our recently announced agreement to acquire Impact Fulfillment Services supports our strategy to accelerate growth in our supply chain business. The transaction is set to add contract packaging and manufacturing capabilities that complement our existing suite of port-to-door logistics services, allowing us to expand with existing customers while adding new brands to our extensive customer base.”

Sanchez also said the company’s enhanced asset management playbook is “leading to improved returns over the cycle.”

“We reduced our tractor rental fleet by 18% year over year to align with lower market demand by redeploying vehicles into longer-term lease, dedicated and supply chain applications,” he added. “In addition, our expanded retail sales capacity has allowed us to sell a higher number of used vehicles through the retail channel and maximize proceeds.”

Sanchez said that the company’s stronger earnings profile our a disciplined capital allocation provide ample capacity for organic growth, strategic acquisitions and returning capital to shareholders through share repurchases and dividends.

“Our board recently authorized new discretionary and anti-dilutive share repurchase programs, as well as payment of our 189th consecutive quarterly dividend, demonstrating that returning capital to shareholders continues to be a key priority for us,” he noted. “We remain confident that our transformed business model is set to deliver a stronger, more resilient return profile while remaining well positioned to benefit from a cycle upturn.”

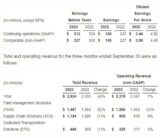

Earnings and total revenue were reported as follows:

3Q 2023 Segment Review

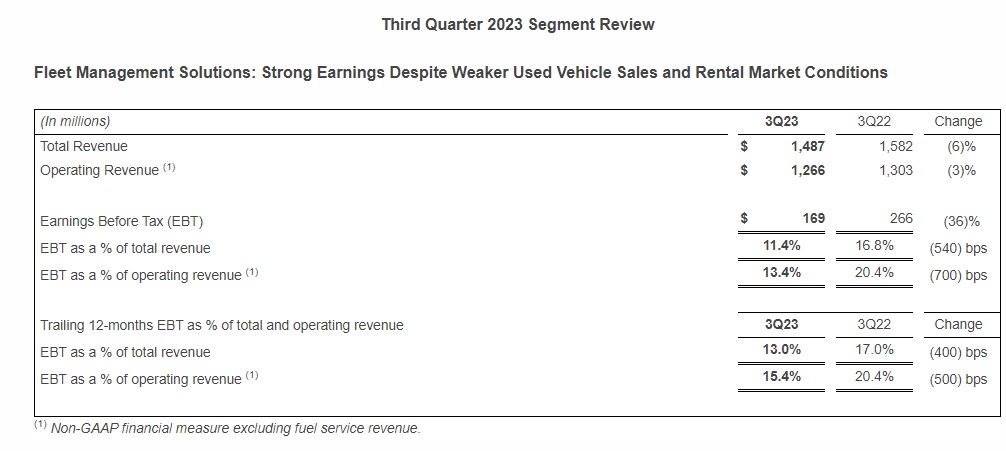

- FMS total revenue and operating revenue decreased 6% and 3%, respectively.

- Total revenue reflects lower fuel revenue passed through to customers and lower operating revenue.

- Operating revenue reflects lower rental demand and 2% negative impact from UK exit, partially offset by higher ChoiceLease and SelectCare revenue.

- FMS EBT decreased to $169 million.

- Reflects lower used vehicle sales and rental results.

- Lower used vehicle gains due to a 30% and 31% decrease in used truck and tractor pricing, respectively, partially offset by higher volumes; sequentially from second quarter of 2023, used truck and tractor pricing decreased 6% and 8%, respectively.

- Rental power-fleet utilization was 75%, down from a record level of 83% in prior year on a 7% smaller average power fleet.

- FMS EBT as a percentage of FMS operating revenue is at the high end of the company’s long-term target of low double digits for the third quarter and above the target for the trailing 12-month period.

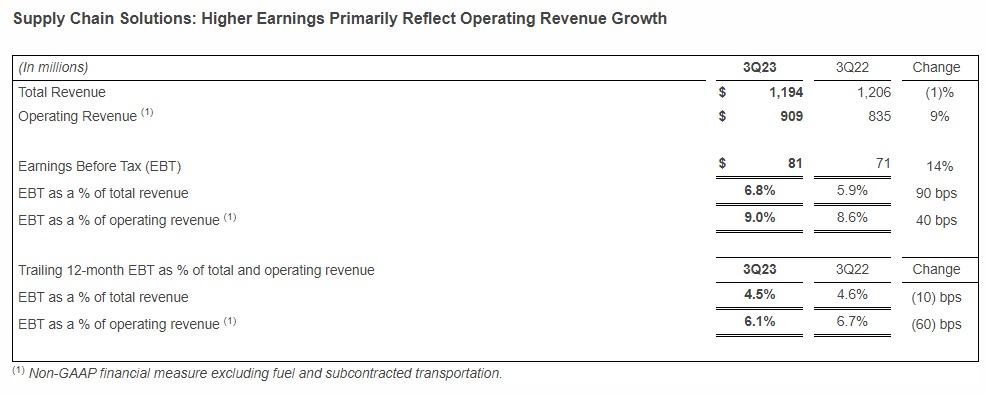

Supply Chain Solutions: Higher Earnings Primarily Reflect Operating Revenue Growth

- SCS total revenue decreased 1% and operating revenue grew 9%.

- Decrease in total revenue primarily reflects lower subcontracted transportation passed through to customers, partially offset by higher operating revenue.

- Increase in operating revenue primarily driven by new business and increased pricing.

- SCS EBT grew 14%.

- Increase primarily due to higher operating revenue and lower incentive-based compensation costs, partially offset by lower volumes in the omnichannel retail vertical.

- SCS EBT as a percentage of SCS operating revenue is within the company’s long-term target of high single digits for the third quarter but below target for the trailing 12-month period.

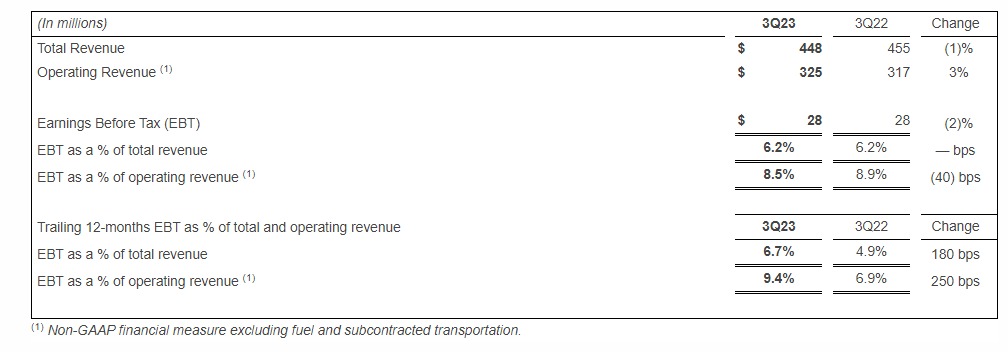

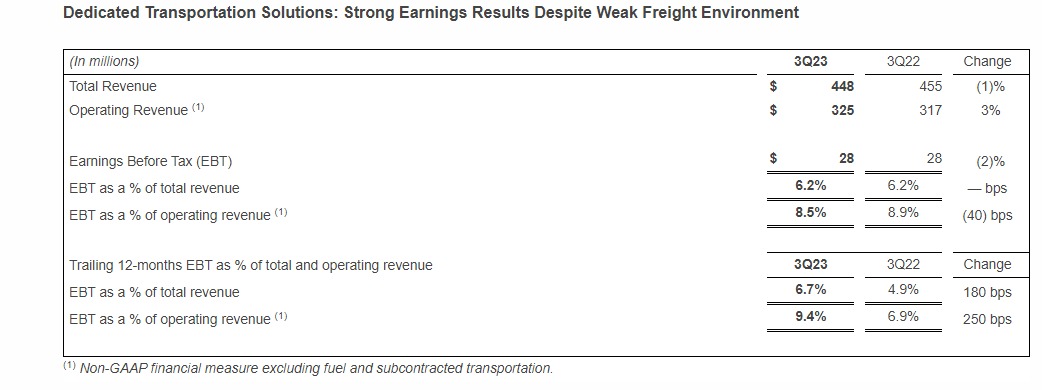

- DTS total revenue decreased 1% and operating revenue grew 3%

- Total revenue reflects lower fuel revenue passed through to customers, largely offset by higher operating revenue

- Operating revenue increased primarily due to inflationary cost recovery

- DTS EBT is generally in line with prior year

- DTS EBT as a percentage of DTS operating revenue is within the company’s long-term target of high single digits for the third quarter and at the high end for the trailing 12-month period

Corporate Financial Information

Unallocated Central Support Services (CSS)

Unallocated CSS costs declined to $20 million from $21 million in the prior year, primarily due to lower professional fees.

Capital Expenditures, Cash Flow and Leverage

Year-to-date capital expenditures increased to $2.6 billion in 2023, compared to $2.0 billion in 2022, reflecting higher investments in the lease fleet and accelerated timing of OEM deliveries, partially offset by lower investments in commercial rental.

Year-to-date net cash provided by operating activities from continuing operations was $1.8 billion, consistent with the prior year, as lower working capital needs were offset by reduced earnings. Free cash flow (non-GAAP) of $32 million, compared to $887 million in 2022, primarily reflects an increase in capital expenditures and prior-year proceeds of approximately $300 million from the FMS UK exit.

Debt-to-equity as of Sept. 30, 2023, was 214%, compared to 216% at year-end 2022, and remains below the company’s long-term target of 250% to 300%.

Share Repurchase Programs

In October, the Board of Directors authorized two new share repurchase programs. Under a new discretionary repurchase program, Ryder management is authorized to repurchase up to 2.0 million shares of common stock at its discretion. Under a new anti-dilutive repurchase program, Ryder management is authorized to repurchase up to 2.0 million shares of common stock issued to employees under the company’s employee stock plans since August 31, 2023. Both programs commenced Oct. 12, 2023, and expire Oct. 12, 2025. The company previously authorized discretionary repurchase program was completed in September, and the anti-dilutive repurchase program expired in October.

Outlook

“Our business model transformation is enabling us to achieve our earnings and return targets throughout the cycle,” said Ryder Chief Financial Officer John Diez. “Despite weakening freight conditions and used vehicle pricing that peaked over a year ago, we have demonstrated the ability to deliver strong results in a difficult environment. We remain confident that the continued execution of our balanced growth strategy will drive long-term value creation and shareholder returns.”

The Trucker News Staff produces engaging content for not only TheTrucker.com, but also The Trucker Newspaper, which has been serving the trucking industry for more than 30 years. With a focus on drivers, the Trucker News Staff aims to provide relevant, objective content pertaining to the trucking segment of the transportation industry. The Trucker News Staff is based in Little Rock, Arkansas.