BEAVERTON, Ore. — National average spot truckload van and refrigerated rates were virtually unchanged during the week ending Feb. 7, a sign of price stability after January’s declines, according to DAT Freight & Analytics, which operates the industry’s largest load board network.

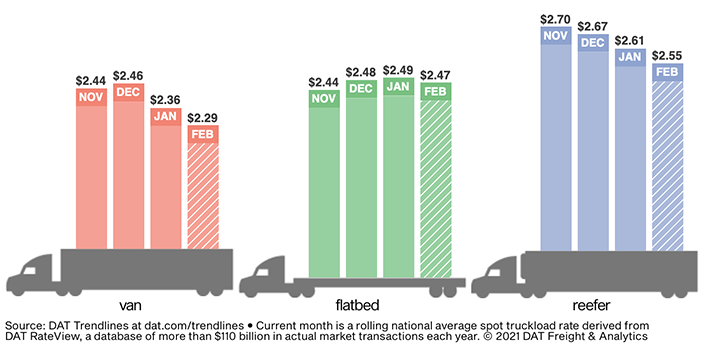

During the first week of February, average van rates were $2.29 per mile, with flatbed coming in at $2.47 per mile and refrigerated at $2.55 per mile (including a calculated fuel surcharge).

DAT analysts point to the following trendlines for 2021 thus far.

Van demand pulls up

Dry van load post volumes increased 7% and the number of posted trucks was virtually unchanged the first week of February, compared to the previous week. The average van load-to-truck ratio was 4.5, up from 4.3 the previous week and 3.2 the week before. The average rate was higher on 58 of DAT’s top 100 van lanes by volume last week.

Port market volatility

Port markets across the country have experienced huge swings in demand for trucks recently. Volumes in Elizabeth, New Jersey, increased 7% compared to the previous week, and the average outbound rate rose 3 cents to $1.90 per mile. On the West Coast, outbound load volume from Los Angeles dropped 14% week over week; in Ontario, the decline was 8%. Tighter capacity in both markets lifted the average outbound rate by 2 cents to $2.35 a mile and $2.43 a mile, respectively.

Temperature-controlled trailer demand

The number of spot reefer load posts on the DAT network increased 13% last week with very little change in the number of trucks posted. The national average reefer load-to-truck ratio edged higher from 8.6 to 9.9 as a result. One driver of reefer demand is that shippers needed temperature-controlled trailers to keep loads from freezing as cold winter weather hit much of the country last week. The number of loads moved on DAT’s top 72 reefer lanes by volume was up 1.8% compared to the previous week. The average spot reefer rate was higher on 19 of those lanes, lower on 39 and neutral on 14.

Spring harvests

It’s peak season for winter strawberries in Florida. In 2020, growers shipped 76% of their annual volume between Jan. 25 and March 28 at an average of 72 truckloads per day, according to the U.S. Department of Agriculture. Last year, Valentine’s Day was the busiest shipping day of the year for winter strawberries.

Flatbed demand rises

Flatbed load and equipment posts each increased 2% last week, leaving the national average flatbed load-to-truck ratio virtually unchanged at 52.8. Load post volumes in DAT’s top 10 flatbed markets increased by just under 1% compared to the previous week. However, the number of loads moved on the top 78 flatbed lanes was up 13.2%, and the average spot rate was higher or neutral on 59 of those lanes. Residential construction is helping. The U.S. Census Bureau reported a 1% increase in construction spending during the month of December compared to November, but that doesn’t tell the whole story. Residential activity was up 3% month over month while nonresidential construction spending declined 1.7%.

Contract rate dynamics

Contract freight represents about 85% of all truckload freight hauled. Changes in contract rates typically lag behind spot rates by four to six months, and the extent to which contract rates rise is driven by how long spot rates are at elevated levels.

Shippers put out a lot of RFPs (request for proposal) late in the third quarter and throughout the fourth quarter last year when spot rates were at record highs. Those 2021 contract rates are now making their way into routing guides — the rates that carriers bid on certain lanes and how much capacity they commit to provide throughout the year.

Higher contract rates will mean lower spot market rates over time, and high diesel prices can erode margins further. It’s still a good pricing environment for truckers, but the price of fuel and the gap between contract and spot rates bear watching.

National average rates are derived from DAT RateView.

The Trucker News Staff produces engaging content for not only TheTrucker.com, but also The Trucker Newspaper, which has been serving the trucking industry for more than 30 years. With a focus on drivers, the Trucker News Staff aims to provide relevant, objective content pertaining to the trucking segment of the transportation industry. The Trucker News Staff is based in Little Rock, Arkansas.