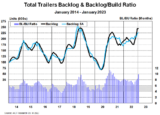

COLUMBUS, Ind. — Demand for trailers is expected to exceed capacity through the end of 2023 as supply chain concerns linger.

And some manufacturers are saying that they see no end in sight.

This is according to ACT Research’s Trailer Components & Raw Materials Forecast issued on March 1, which also notes that some fleets are taking a wait-and-see attitude and splitting orders to hedge their bets for later in the year.

Jennifer McNealy, director of Commercial Vehicle Market Research & Publications at ACT Research, said that “January OEM business conditions, including 2023 demand expectations and labor, were on-par with December, overall, with a bias toward the ‘better’ side of the pendulum for labor. (However,) concerns about demand and the material supply chain on the minds of respondents.”

“Demand overall remains robust, and cancellations are low, but we are hearing that some orders are being made to replenish dealer stock, rather than going directly to fleet customers,” she added.

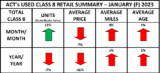

Meanwhile, an additional ACT report shows that used tractor retail volumes (same dealer sales) increased by 12% month-over-month in January, with average mileage increasing by 8% month-over-month. Average prices are down 7% and age is up 1%, according to ACT.

Average price and volumes were lower with age and miles higher year-over-year.

“Same dealer Class 8 retail truck sales saw a second month of sequential gain in January, up 12% from December,” said Steve Tam, vice president at ACT Research. “Sales typically see a moderate decrease (≈7%) in January, so the increase was departure from seasonality. However, expectations called for the disconnect. The assumption was based on strong new truck sales in November and December, which helped to relieve some of the pent-up demand the used truck market suffered through most of 2022.”

Tam added that “as conditions in the secondary market tighten, it is interesting to see those truck owners who were selling their own equipment turn back to dealers and auctions to handle transactions. While participating dealers reported a 12% month-over-month increase in sales, we estimate the total industry saw about a similar decline in sales.”

Many in the industry are voicing concerns about the health and viability of owner/operators and small fleets, particularly as freight rates fall and operating costs rise, Tam said.

“While the economy may avoid a recession, inflation remains a very real concern,” he concluded. “With that in mind, we expect, the market to fall as much as 10%.”

The Trucker News Staff produces engaging content for not only TheTrucker.com, but also The Trucker Newspaper, which has been serving the trucking industry for more than 30 years. With a focus on drivers, the Trucker News Staff aims to provide relevant, objective content pertaining to the trucking segment of the transportation industry. The Trucker News Staff is based in Little Rock, Arkansas.