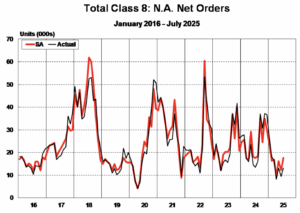

COLUMBUS, Ind. – Final North American Class 8 net orders totaled 13,172 units in July, down 2.1% y/y, as published in ACT Research’s latest State of the Industry: NA Classes 5-8 report.

“July marks the seventh consecutive month of y/y Class 8 order declines,” said Carter Vieth, research analyst, ACT. “Tractor orders increased 6.6% y/y to 8,314 units, but considering July is the weakest month for orders, delayed planning due to tariffs seems responsible for the modest bump in July tractor orders as weak fundamentals remain in place.”

Vocational Orders Continue to Slide

“Vocational orders totaled 4,858 units, down 14% y/y,” Vieth said. “Vocational orders continue to flounder on a troika of headwinds.”

- EPA’27 low-NOx rules are now highly uncertain, with most fleets now thinking a complete repeal is the way forward, removing the need for pre-buying.

- Slowdown in housing, manufacturing and private construction, plus continued elevated financing costs are weakening demand in key vocational sectors.

- Tariff-related equipment costs/uncertainty are keeping fleets on the sidelines for longer.

Regarding medium duty, Vieth noted total Classes 5-7 orders fell 16% y/y to 13,159 units. MD orders have slowed notably across the past seven months, with still elevated inventories, and a weaker economic outlook. Slowing services momentum is a particular concern for MD demand.