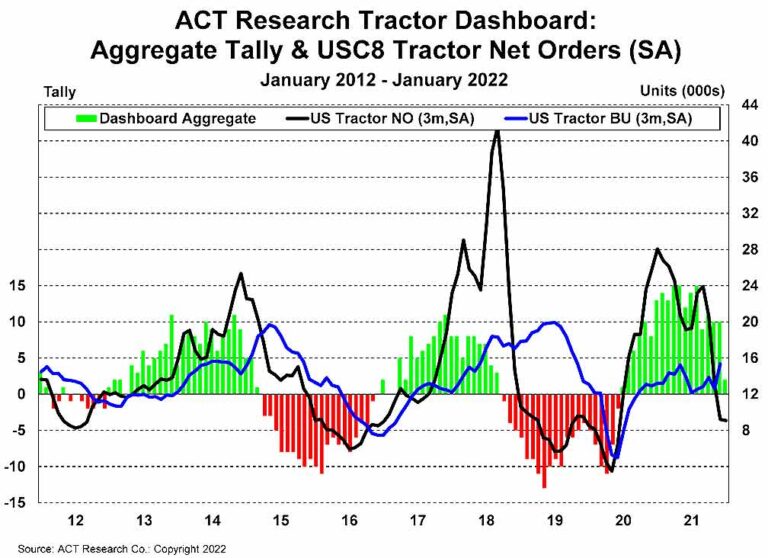

COLUMBUS, Ind. – According to ACT Research’s recently released Transportation Digest, the top line on ACT’s Tractor Dashboard in January took a steep drop from December levels.

The report, which combines proprietary ACT data and analysis from a wide variety of sources, paints a comprehensive picture of trends impacting transportation and commercial vehicle markets.

This monthly report is designed as a quick look at transportation insights for use by fleet and trucking executives, reviewing top-level considerations such as for-hire indices, freight, heavy and medium-duty segments, the U.S. trailer market, used truck sales information, and an overview of the U.S. macroeconomy.

“The 8-point plunge in the top line tally is the biggest month-to-month decrement across the 12 years of history available to us in this monitoring tool. It is important to note that the buildup in Russian forces on the Ukraine border had just started in January, so the threat of a conflict had little or no influence on the result,” Kenny Vieth, ACT’s president and senior analyst, said.

“The most notable and concerning recent development has been the signaling from the five ‘macro & financial’ row items in the Dashboard. Three are now in negative territory – consumer goods spending, residential construction expenditures and trucking stocks. Positively, the freight metrics are holding, and that remains encouraging for our forecast. As production and supply-chain obstacles have mounted the last 12 months, industry metrics like net orders, inventory levels and cancelations have become less trustworthy in telling their tales.”

Veith said there is reason to believe independent of Ukraine developments of the last few weeks that the lead indicators were signaling some market vulnerability ahead in the summer months.

“It will be hard to tease this out from the volatility associated with wartime developments, but it reinforces the notion of increased downside risk,” Veith said. “That said, we believe that the dashboard offers a three to six-month forward-looking metric for conditions in the tractor market, but we always warn that it’s never wise to forecast on the basis of just one indicator, or even an aggregation of indicators.”

The Trucker News Staff produces engaging content for not only TheTrucker.com, but also The Trucker Newspaper, which has been serving the trucking industry for more than 30 years. With a focus on drivers, the Trucker News Staff aims to provide relevant, objective content pertaining to the trucking segment of the transportation industry. The Trucker News Staff is based in Little Rock, Arkansas.