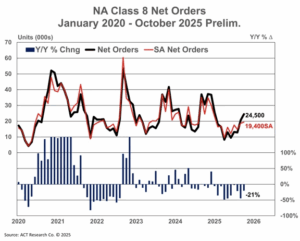

COLUMBUS, Ind. — October preliminary North America Classes 5-8 net orders of 40.0k units declined 17% y/y.

“Preliminary Class 8 orders totaled 24,500 units in October, down 21% y/y, a notably weak number when you take into consideration October is seasonally the strongest month for orders with a 25% seasonal factor,” said Carter Vieth, research analyst at ACT Research. “This is the time of year when next year’s backlogs get built. Rising costs, still weak spot rates, and ongoing uncertainty continue to hamper for-hire carriers, and as a result, have led to a muted order season to date. Additionally, private fleet demand has slowed after recent expansion.”

September orders were down to the lowest numbers since 2019.

Complete industry data for October, including final order numbers, will be published by ACT Research in mid-November.

Regarding medium duty, Vieth added, “Preliminary reporting shows October NA Classes 5-7 orders decreased 11% y/y to 15,500 units. Economic uncertainty and rising consumer pessimism continue to weigh on Classes 5-7 demand.”

What do these numbers mean? Orders are delayed because of uncertainty with tariffs? Are you insinuating the demand for trucking is declining?