WASHINGTON — The American Transportation Research Institute (ATRI) has released the findings of its 2023 update to An Analysis of the Operational Costs of Trucking.

A record number of motor carriers participated in this year’s research, which analyzes a wide variety of line-item costs, operating efficiencies, and revenue benchmarks by fleet size and sector, according to an ATRI news release.

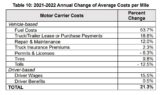

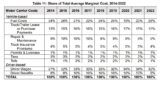

Total marginal costs climbed to a new high in 2022 for the second year in a row, increasing by 21.3% over 2021 to $2.251 per mile, the report notes.

Though fuel was the largest driver of this spike (53.7% higher than in 2021), multiple other line-items also rose by double digits. Driver wages increased by 15.5%, to $0.724 per mile, reflecting the ongoing industry effort to attract and retain drivers.

Driver benefits, however, remained stable in 2022, according to the report.

Atypical market conditions posed unique challenges for acquiring and maintaining equipment in 2022.

Truck and trailer payments increased by 18.6 percent to $0.331 per mile as carriers paid higher prices, largely due to equipment impediments in the supply chains. Closely related, parts shortages and rising technician labor rates pushed repair and maintenance costs up 12 percent to $0.196 per mile.

In response to rising costs, motor carriers initiated improvements in key operational efficiencies.

For example, driver turnover, detention times, and equipment utilization each improved across nearly every fleet size and sector during 2022. This year’s report includes new metrics such as mileage between breakdowns and the ratio of truck drivers to non-driving employees.

Despite falling rates throughout the year, average operating margins were at least six percent in all sectors. While larger fleets’ average operating margins improved from 2021 to 2022, smaller fleets saw operating margins decline.

“In a softening market with costs rising at an unparalleled pace, carrier benchmarking becomes more critical than ever,” said Dave Broering, President of NFI Integrated Logistics. “ATRI’s newest Operational Costs report provides the reliable data and analysis we need to better understand our partners’ underlying costs in a volatile economy and decelerating rate marketplace.”

A full copy of the report is available through ATRI’s website by clicking here.

The Trucker News Staff produces engaging content for not only TheTrucker.com, but also The Trucker Newspaper, which has been serving the trucking industry for more than 30 years. With a focus on drivers, the Trucker News Staff aims to provide relevant, objective content pertaining to the trucking segment of the transportation industry. The Trucker News Staff is based in Little Rock, Arkansas.

I believe that the high cost of fuel has forced the semi truck owners to raise their delivery prices and I certainly don’t blame them. Unfortunately, this has resulted in the outrageously high prices in the super markets, clothing stores, shoe stores and other stores necessary for the average American family to survive.. You have to feed your family as well as provide new clothing and shoes for the growing children every year. I really feel that this whole issue could be resolved by the government simply declaring that we are undergoing an economic crisis due to the oil and gas companies gouging the American citizens and force those companies to lower their prices..